No surprise that Big Bass Halloween 2 made it into the main charts after topping the Halloween game charts last month. Whilst not a new game, Hacksaw Gaming’s Wanted Dead Or A Wild also made it into the charts this month. This is as much a reflection of their market share progress as the game itself. Legion Gold And The Sphinx Of Dead (Play’n GO) made a brief appearance mid-month. Otherwise, most games held their own so let’s turn to the theme of the month: imitation as a form of flattery.

Top 20 games by distribution

Game intellectual property

A handful of recent IP suits may signal a litigious trend in our sector. Here’s a quick summary of the cases and then a top-level view of the numbers around game similarity.

Dragon Train was pulled by Light & Wonder in September following a case brought by Aristocrat Gaming relating to game mechanics and copyright infringement of their Dragon Link game. Evolution Gaming is suing Light & Wonder too, arguing that RouletteX is a copycat of their Lightning Roulette title.

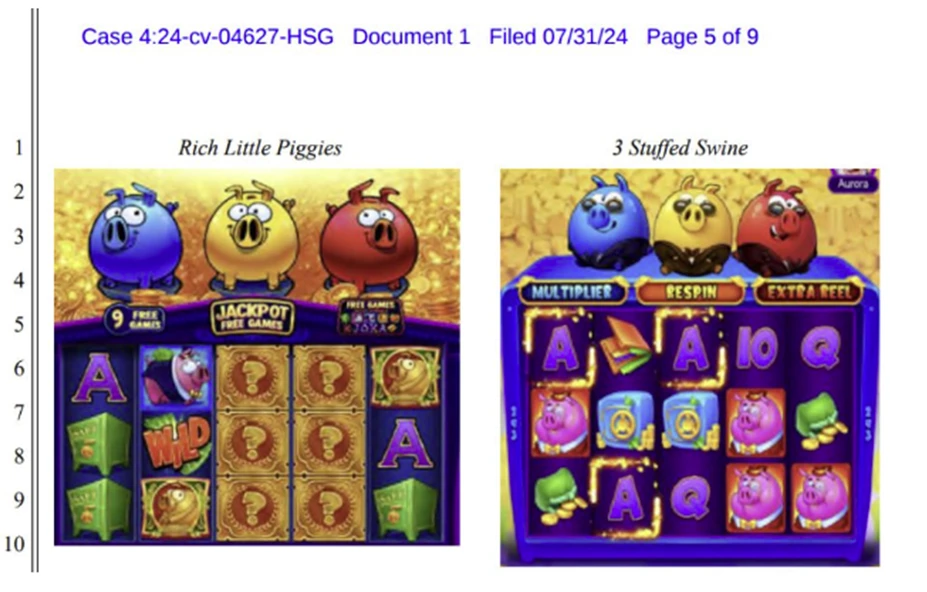

In retaliatory fashion, L&W took Zeroo Gravity to court in California claiming that 3 Stuffed Swine is a blatant copy of their own Rich Little Piggies.

If you can’t beat ‘em, join ’em seems to be the motto…

The removal of the offending game has led to a withdrawal of this last claim, however.

Meanwhile a whopping $330m of damages were awarded to Aviator LLC in Georgia, former owners of Adjarabet, against new owners Flutter plc plus the studio Spribe, providers of the successful Aviator game. In response Flutter has launched an appeal that could take years, rejecting the claims as baseless.

We can’t help thinking that spending so much time and money on legal proceedings detracts from the goal of creating and distributing content to make money. Yet protecting the investment that goes into that same creativity may have merit.

Whilst our expertise is not IP, we thought it worth summarising some game similarities, based on the 70,000 games we track across 3,500 operators.

Of all casino games on our database, over 1 in 7 (15%) bears the same name as another, i.e. is a ‘duplicate’ game name. Popular game names include Gold Rush and Cleopatra, for example – see our casino review of 2022 for more.

There are 2,200 roulette games out there, of which half are live dealer versions. There are around 40 variations of the classic live roulette game. Of these, more than 20 share similarities with Lightning Roulette, in the sense of using multipliers or bonus rounds based on a handful of extra lucky numbers.

Many of these ‘multiplier roulette’ variants share similar paytable changes, i.e., reducing the classic 35:1 single number payout to 29:1, and reallocating the difference to the multiplier prize fund. The lucky number bet rewards are often set at around 500x the stake and, with a handful of variations according to bet type, most still target the traditional European Roulette RTP of 97.3%.

Interestingly, roulette games with progressive jackpots have been around longer than all the ‘multiplier’ variants.

On the piggy front, we have 265 games that feature the animal, of which 46 share the same name. So, for example, there are 8 Golden Pigs, 8 Piggy Banks, 4 Fortune Pigs, 4 Three Little Pigs, and even 2 Rich Piggies and 2 Piggy Riches.

So, as names go, there is plenty of duplication, though not in the California case. What seems to have hit a nerve here are the imagery and/or game mechanic similarities. Piggy graphics tend to be similar, not least as the subtheme of three little pigs dates back to old nursery tales (see top graphic). A graphic filed as part of the L&W case though (and reproduced by sbcnews) seems to support the description of ‘blatant imitation’.

Copying competitor products or features is common across all industry sectors and in ours the raft of Big Bass lookalikes is just one reflection of this. The issue may boil down to a) how unique is the original concept, its graphics, name or mechanics and b) how blatantly something is copied, or not.

Having witnessed some legal departments run as profit centres, it would be a shame if our casino headlines became dominated by non-productive litigation cases in 2025. That said, it doesn’t take too much effort to differentiate a product by brand name or imagery.

From a data perspective, assigning games to their correct studios becomes more challenging for us at egamingmonitor.com when game names are identical. While this is a technical grumble we have with duplicates, it’s still surprising that over 10% of all games fail to use original titles.

Below the surface, these cases may also have a subtheme of personal discontent, such as disputes between employers and ex-employees or acquiring companies versus previous owners.

When it comes to game engines, innovations are important to our sector, and worth protecting, whether these are Megaways, crash mechanics or concepts such as ‘Roulette Up’. The complex mix of variables that contribute to game performance, however, does also mean that imitation is no guarantee of success!

Game distribution and sourcing

TaDa Gaming, Bgaming and 1Spin4Win continue to secure new aggregator partners and so sit at the top of our busiest studio dealmaker chart.

Biggest aggregator dealmakers

As per last month too, aggregator Everymatrix retained the top spot as the busiest aggregator of the previous six months but both Hub88 and Slotegrator are hot on their heels in securing new studio deals.

Stay tuned for our upcoming Q3 review, packed with data on studio performance, game metrics, and much more.

Biggest studio dealmakers

* Please note these are live charts which update every month so please ensure the month of November 2024 is selected in the drop-downs to match the analysis

**The interactive games chart at the top excludes live games and table games. Game rankings are determined by the number of game appearances on the casino homepages of more than 3,500 casino sites. To access many other charts including game rankings, live and table games, positions on subpages or to filter game performance by game theme, game feature, market or operator, please get in touch with our partner, egamingmonitor.com. Egamingmonitor covers 70,000 games, 1,700 suppliers and 3,500+ operators.

Original article: https://igamingbusiness.com/casino-games/casino-dashboard-december-2024/