Welcome to episode two of our five-part Betting Hero Consumer Insight Series. In this week’s edition, we explore the common consumer frustrations which can result in poor loyalty across even the leading sportsbooks in North America.

In last week’s episode, we highlighted many of the challenges consumers face when attempting to register for a new account, as well as the challenges in the funding and betting journeys that follow. Based on our proprietary insights, we determined that even the industry’s most active and valuable bettors experience high volumes of issues that prevent them from registering for, funding on, or betting with their preferred sportsbooks, resulting in poor customer satisfaction and loyalty.

Because we know that customer acquisition for sportsbook operators remains a challenge, and that many motivated bettors will be unlikely to complete their respective registration and initial funding journeys, we believe that more could and should be done to retain those bettors that are successful.

Unlike in many other industries, switching costs for sports betting consumers are relatively insignificant and incentive to switch is relatively significant. To ensure a healthy and sustainable industry, this continued effort to retain customers must be shared between all key stakeholders: operators, affiliates, payments companies, geolocation companies, technology companies and more.

The insights

A recent consumer study by our research division (highlighted below) analysed the day-to-day behaviours of 720 sports bettors and how their frustrations would impact satisfaction and loyalty.

Our hypothesis was that consumers would cite a variety of frustrations that impact their decision-making process about which sportsbooks to use on a daily basis, therefore resulting in high level behavior that is less conducive to single-operator loyalty, but instead leans towards bettors spreading their play across more than one sportsbook depending on their specific needs and wants.

Number of jurisdictions: 3 US States + 1 Canadian Province

Number of respondents: 720

Number of total accounts registered for: 2,520 (AVG 3.5 p/respondent)

Frequency of bets: 32% bet on sports at least once per day

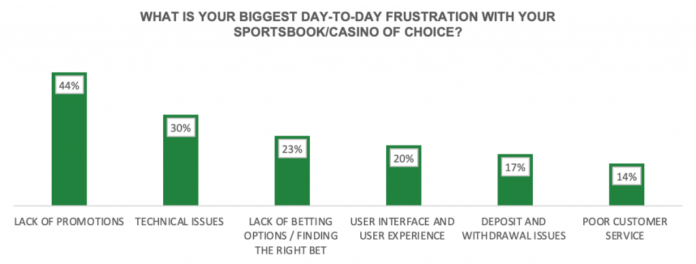

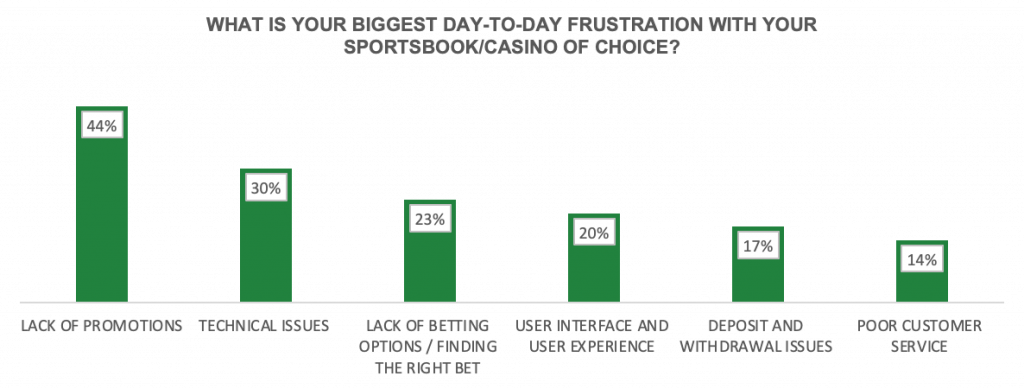

When asked a multiple choice question about the biggest day-to-day frustrations encountered with their sportsbook of choice, the responses were varied, potentially supporting the theory that for each individual persona there is one or more sportsbooks best suited. For example, 44% of respondents cited a lack of ongoing promotions as one of their biggest day-to-day frustrations. This might partially explain why on average the 720 respondents had registered for 3.5 accounts each.

Additionally, 30% of the respondents cited technical issues (such as app unresponsiveness or the inability to place a bet) as one of their biggest day-to-day frustrations. Consistent with the findings highlighted in episode one of this series, these technical issues may well have impacted respective consumer decisions to register for more than one sportsbook account.

The remaining responses were as follows: Lack of betting options or the inability to find their bet of choice – 23%, poor UX/UI design – 20%, deposit and withdrawal issues – 17%, and poor customer service – 14%.

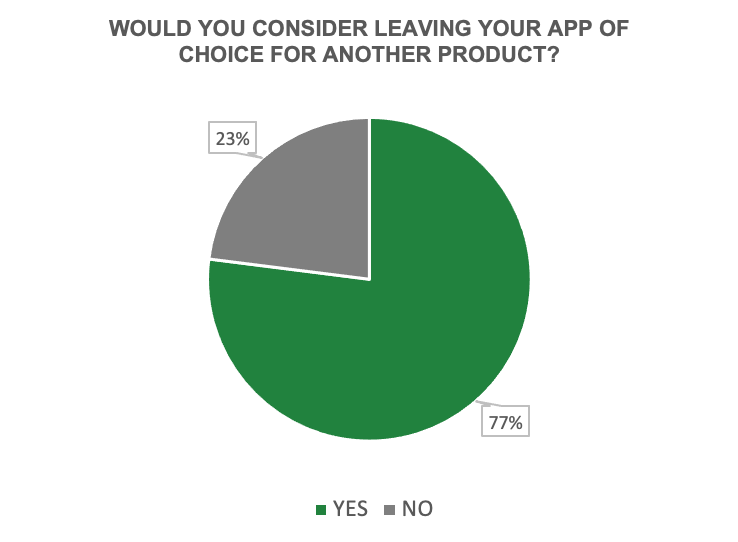

When asked whether or not the respondents would consider leaving their current preferred sportsbook app for another, the response was overwhelming. 77% of bettors said that they would leave while only 23% said that they would not.

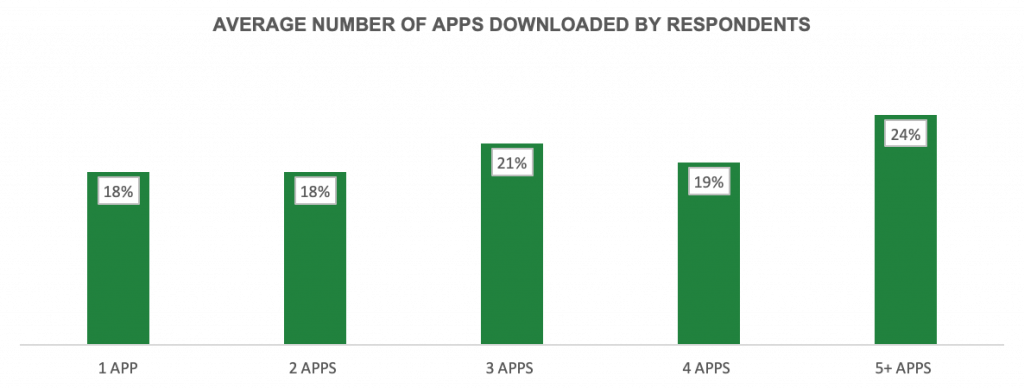

This apparent lack of loyalty is compounded by the behavior of consumers as it relates to the number of accounts they have registered for and still currently use. Among this cohort, 64% of respondents have registered for three or more accounts (3 apps – 21%, 4 apps – 19%, and 5+ apps – 24%).

Many would argue that the vast majority of these bettors may be bonus hunting but that theory is somewhat disproved when considering that 50% of the same cohort still actively use two or more of the sportsbooks that they originally registered for. This further supports our initial hypothesis that consumers choose to spread their play across more than one operator platform and that respective apps can be used to satisfy the specific wants and needs of bettors. For example, a bettor that primarily uses the FanDuel app because of the platform’s user interface may also choose to bet with BetMGM for access to preferred promotions, or PointsBet for better odds.

In next week’s episode I will explore these consumer perceptions of the leading sportsbooks in North America and identify the trends between brand awareness, app preference, and operator loyalty. I hope you’ll join me.

*Insights referenced collected by Betting Hero Research between March – September 2022

About Betting Hero

- We are widely known as the No. 1 live activation company in sports betting and igaming having delivered more than 300,000 new depositing customers to our strategic partners since inception.

- Uniquely as an affiliate; we engage, educate and activate customers via in-person interactions.

- We help sportsbook operators achieve their most critical goals across customer acquisition (Hero Activation), customer retention (Hero Research) and customer development (Hero Hotline).

Unlike online affiliates that largely convert customers using digital content and promotional comparisons, our in-person teams educate hard-to-reach, high-value consumers on the unique benefits of respective sports betting products before guiding them through their registration, funding and betting journeys. As a result of our expert activation teams and concierge approach to customer education and acquisition, we are proud to boast an app-download-to-bet-placed conversion rate of over 80%, which happens to outperform the industry average (~50%) by more than half. Here is an example of one of our How To tutorials.

Original article: https://igamingbusiness.com/tech-innovation/day-to-day-consumer-frustrations-resulting-in-poor-sportsbook-loyalty/