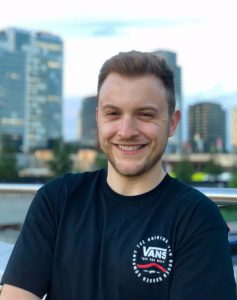

Ben Smith works for Leadstar Media as a Team Leader. The Stockholm-based affiliate company operates more than 50 websites in over 25 geographical markets, and Ben helps to oversee the UK, US, and Canadian products.

With calls for new restrictions on the British gambling industry, many small businesses in the sector are targeting growth in other markets. For those staying put, there is now a need to market their services effectively in order to gain profitable market share.

According to the most recent Gambling Commission figures, covering April 2020 to May 2021, there were 2,439 licensed operators in the British market. Remote licensees generated gross yield of £6.9bn over this period, up 18.4% despite sporting cancellations resulting from the Covid-19 pandemic.

So while the online sector is large and growing, it is also highly competitive, meaning effective marketing is all the more important. Smaller brands operating in the market have to seek alternatives to traditional advertising if they wish to compete, Ben Smith of Leadstar Media says

“It’s simply a waste of time and budget even trying to explore competing with the big brands.” Smith says. “Even with print advertising and shirt/event sponsorships, you’re shooting yourself in the foot nine times out of ten because the bigger brands still sweep up the more prestigious slots.”

At Leadstar they believe that with a more focused approach, smaller brands can keep their spend down and still find ways to target potential players through prioritising affiliate marketing.

Why affiliates?

Gambling affiliates drive traffic to gaming operators. According to Semrush, in the UK, for every 1,000 words searched, 60 included the word ‘bet’ or ‘betting’. This upwards trend is made all the more evident when 5% of total Google search results by category pertained to gambling terms in 2021.

Smith believes that smaller operators can optimise marketing through positioning themselves on the websites which their target market lands on as opposed to investing in owning space in the top spots.

In doing so, small businesses are being exposed to exactly the people they are looking for whilst minimising the costs.

“Of course, the audience is limited compared with traditional advertising markets, but the conversion is greater and more importantly, measurable,” Smith says.

“Brands have more control over their cost per acquisition, and can be legitimised by being placed right in amongst some of the top online bookmakers.”

According to data from Leadstar’s Bookiesbonuses.com site, smaller brands are often preferred by customers.

Smith says that “customers that arrive on the Bookiesbonuses.com homepage tend to do so when searching for new betting options, whether that is regarding the top betting sites in the market, or the latest offers”.

“What lots of these people really want is new brands to sign up with and ultimately claim the welcome bonus. We know this because every time a new betting site is added to our main list, they are among the most popular brands for a period of time after their addition.”

But, as Smith argues, “the brands that actually have a quality product have been able to retain those players and see longer term value from them”. This is where utilising affiliates has become important.

With them, not against them

The likes of William Hill, Betfred, Flutter’s Paddy Power and and Entain brands such as Ladbrokes and Coral have dominated television advertising for years. However, it’s not just these brands, the majority of which still have a high street presence, that dominate the market.

Many early online only bookmakers have already beaten the old land based operators, with Bet365 the most notable example, as well as Flutter’s Sky Bet and Betfair.

Leading brands use above the line channels with sizeable affiliate programmes- both traditional and digital – and, consequently, these programmes take up a much smaller chunk of their acquisition.

Smith says eyeballs are constantly on the big brands in part because they continue to put their name out there, but, ultimately, because most of these brands still have a superior product.

“They use their big budgets to constantly optimise their products and offer lucrative rewards and benefits that not every online betting site can.”

Smaller operators don’t have the ad budgets to compete with the bigger brands, and therefore need to tailor their growth strategy to reflect this reality. This can be done by building a strong network of affiliates, whilst scaling at a rate that is manageable and financially viable Smith suggests.

“These smaller brands might not be able to afford a television slot right before a Premier League fixture, but they can put the hard yards in and develop relationships with blogs, influencers, and any platform where there is the potential to gain exposure in a logical way,” he says.

“If brands find the perfect partners, and couple that with a smart SEO strategy, they can pick off low hanging fruit which the bigger brands are ignoring in favour of their bigger, bolder campaigns.”

Bonus hunters

Attractive bonuses seem to be a big factor when it comes to choosing a betting site. However, whether this acquisition tactic is sustainable over time for smaller brands is debatable. And it’s not just a case of acquiring the customer – there’s still work to do to keep them playing regularly.

“By appeasing bonus hunters, you at least capture a large chunk of your potential customer-base,” Smith says. “After that, it all comes down to retention, which if you have a good product, is not unattainable.

“An attractive bonus is the first impression, but certainly not the final one.”

There is an argument that customers at smaller brands are only there for the bonuses from providers before moving to bigger operators. However Smith argues that this is only a problem for the brands with a poor product.

“A quality product with lots of content, a nice layout, top-end software and good odds should be seen as must-have, but this is in addition to bonuses, rather than an alternative to them.”

“Bonus hunters would only go back to the higher-profile brands if there was no reason to stick around on any given smaller betting site,” he says. “But, whilst it’s difficult to compete with the diverse, complete products that many of the top betting sites have become, there are still areas in which new firms can excel.”

He says that it’s a case of offering something unique, that bettors will respond to. “Whether it’s to do with the website layout, promotions, in-play betting features, odds boosts, or any of the other areas in which you can win – you can avoid losing all those players to the big boys.”

Of course, there are risks for gambling affiliation, whether that comes in the form of tighter regulations for the sector, or controls such as deposit limits and affordability checks.

The new Gambling Act coming in this year could further impact customer value and affiliate commissions, meaning companies not only have to work hard to carve out space in a crowded market, but also be able to adapt and evolve as these new measures come into effect.

As Smith points out, small businesses in the sector need to be savvy about where they invest money. Through partnering with affiliates, they can still be among some of the most popular in the industry.

Original article: https://igamingbusiness.com/how-small-businesses-can-get-established-in-the-worlds-biggest-igaming-market/