F

ollowing up from our recent analysis at Slotsia of how much the gambling industry has impacted the UK market in recent years, it’s clear that its presence has been on an upward trend. A lot of that comes down to its overall visibility. Nowadays, you see major brands advertised across all major social media channels, on TV and at the majority of sporting events.

So, the question is: what do these numbers really mean and how can they be used to assess the current state of the market and its prospects? In this piece, I’m going to try and answer this and outline what I discovered when combing over the data.

Why The Research Is Important and What It Means

Whilst the research itself is unlikely to attract much attention from the average gambler, its collation is of great importance elsewhere. This kind of information helps the regulatory body governing the UK market, the United Kingdom Gambling Commission (UKGC), along with operators, to analyse certain patterns and put measures in place to prevent the rise of problem gambling.

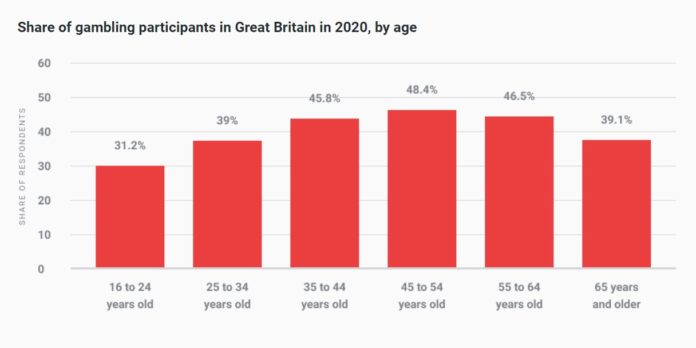

As the numbers show, just under a third of 12 to 24-year-olds gamble in one form or another and that percentage steadily rises with age. Therefore, it’s reasonable to suggest that as more people take part the potential for issues to arise grows alongside. By compiling usage data, steps can be taken to better protect the most susceptible individuals as new information on the latest gambling trends comes to light.

Also, from a purely fiscal perspective, the research enables operators to identify which platforms and/or games are the most successful. By analysing the information, sites can prioritise certain targets and allocate the necessary funds to expand appropriately, thereby lowering the chances of unsuccessful ventures.

The Comparison Between the Number of Male and Female Players

Of course, gambling is available to all irrespective of gender; the only restrictions relate to age and various jurisdictional regulations. Since 2015, the share of people who have participated in at least one form of gambling in Great Britain within a specified period has seen a marked rise, growing from 29.2% – 47.3%. However, does the breakdown show any specific trends between male and female players?

Well, based on the last 5 years of data, there is clearly an upward trend between genders but there also exists an evident disparity. The percentage of male participants has grown from 17.9% to 26.7%, whilst the percentage of female users has increased from 11.3% – 20.6% – an equal rise of roughly 9%. However, what is interesting is that throughout this growth the difference between male and female participants has remained somewhat stable, sitting between 6-8%.

Ultimately, the data implies relatively equal growth within the industry but the comparison does reveal a greater inclination to gamble in males.

The Value of The UK Gambling Industry

The UK gambling industry is a financial behemoth. When you talk about its revenue stream, you’re not talking about millions of pounds, you’re talking billions. However, the cash flows both ways and for any industry to remain successful it must consistently turn a healthy profit to prove its sustainability.

This is where the Gross Gambling Yield (GGY) comes in. The GGY refers to the calculation that determines the value of a gambling operator, which takes into account its profits and losses. Considering this on a wider scale is a great way to realise the overall financial health of the UK gambling industry and helps to gauge its future.

As a whole, the industry has flourished in the last decade. High street betting shops, online counterparts and mobile-compatible sites accounted for £8.44 billion at the start of 2010 and, since then, the numbers have only gone one way – the latest figures (2020) infer that the industry is now worth a staggering £14.22 billion.

Each year previous to 2015 saw a steady increase in the GGY but it soared between March 2015 – March 2016, the question is: why?

There are several reasons, but it’s mainly because The Gambling Act 2014 (for Licensing and Advertising) changed the British gambling industry’s point-of-supply scheme for remote gambling into a point-of-consumption system. The alteration criminalised the remote provision of gambling facilities to British players from persons in another jurisdiction without the relevant licence.

Whilst that would seem counterintuitive to financial growth, what it actually did is result in an uptick of legitimate operators applying for and obtaining UKGC certification, thereby increasing the availability of legitimate sites and their availability to players.

5 Things I Learned

Spending hours looking over the UKGC data was interesting to say the least: I discovered multiple new things around the UK gambling industry.

1. The most popular form of UK gambling is something you might not expect: It was a surprise to see that, although sports betting dominates advertising channels, it’s the UK’s national lottery that draws the highest percentage of players. The statistics show that 27.3% of UK gamblers participate in the national lottery, whereas sports betting only accounted for 5.3% of the 2020 figures.

2. Those with the least tend to gamble the most: What came as less of a shock is that households with the least disposable income spend the most on gambling. It could be explained by targeted advertising but it’s more likely that low-income earners tend to dream about landing huge payouts and life-changing jackpots.

3. There was a sharp uptick in users from 2016 onwards: Gambling has been a widespread pastime for years but it’s surged immensely in the past 5 years. Part of the reason for this is the rise in mobile-compatible casinos and betting sites enabling players to place bets whenever and wherever they choose. The figures for the year previous (2015/16) showed 24.55 million active accounts – only a 0.47 million increase on the year before. However, the number of accounts dramatically rose to 32.63 million between 2016-2017.

4. Most people don’t gamble as often as you might think: As popular as gambling is, the majority of players (32.2%) often stick to a routine, only playing once per week. The remaining habits mentioned are listed as: less than once a month/less than once a week (30.8%), 2+ days a week (22.1%) and less than once a month (14.9%).

5. The UKGC ensures the industry adheres to the most stringent demands: It wasn’t until I sat down and compared nations that I found out just how more demanding the UKGC is than its counterparts elsewhere around the world. Of course, this does mean users/operators are subject to tighter regulations but that’s not a bad thing; players can rest safe in the knowledge that UK operators provide one of, if not the most, secure environments in which to gamble.

What I Expect In The Future

After taking a look at the numbers, it seems as though we’re in the golden age of the UK gambling industry. Recent technological advancements have clearly resulted in the growth of the market, with many players turning to mobile alternatives as they became increasingly available.

What’s not as set in stone is the future. Although the current model proves the industry’s sustainability, certain changes in legislation could instantly impact the UK market. Equally, technology is always progressing, which means operators and developers will have to adapt alongside. That, however, is somewhat more exciting as it could mean brand new creations come to light, giving players even more reason to get involved.

Original article: https://www.yogonet.com/international//noticias/2021/09/02/59100-what-does-uk-gambling-market-research-really-means-and-how-can-it-be-used