B

ally’s Corporation’s Board of Directors has increased the company’s existing share repurchase authorization to $350 million in outstanding shares of common stock, announced the casino-entertainment giant on Monday.

“With the closing of the Gamesys acquisition and the company’s new $4.065 billion comprehensive debt package, the Bally’s Board of Directors found it appropriate to increase the company’s existing share repurchase authorization to maximize flexibility on capital allocation opportunities to drive long-term shareholder value,” said Bally’s in a press statement.

The decision is believed to align with the company’s strategic approach to capital allocation, which has allowed it to invest in growth opportunities and create significant value for stakeholders.

Bally’s expects to evaluate capital opportunities “regularly”, which includes repurchasing outstanding shares. This will be possible thanks to the company’s strong balance sheet, ample liquidity and substantial free cash flow generation.

The repurchase program will allow Bally’s to make repurchases “from time to time” using a variety of methods. These include open market purchases, in block trades, accelerated share repurchase transactions, exchange transactions, “or any combination of such methods.”

The company has further stated that the repurchase program does not obligate it to acquire any particular amount of ordinary shares, while the program may be suspended or discontinued “at any time at Bally’s discretion.”

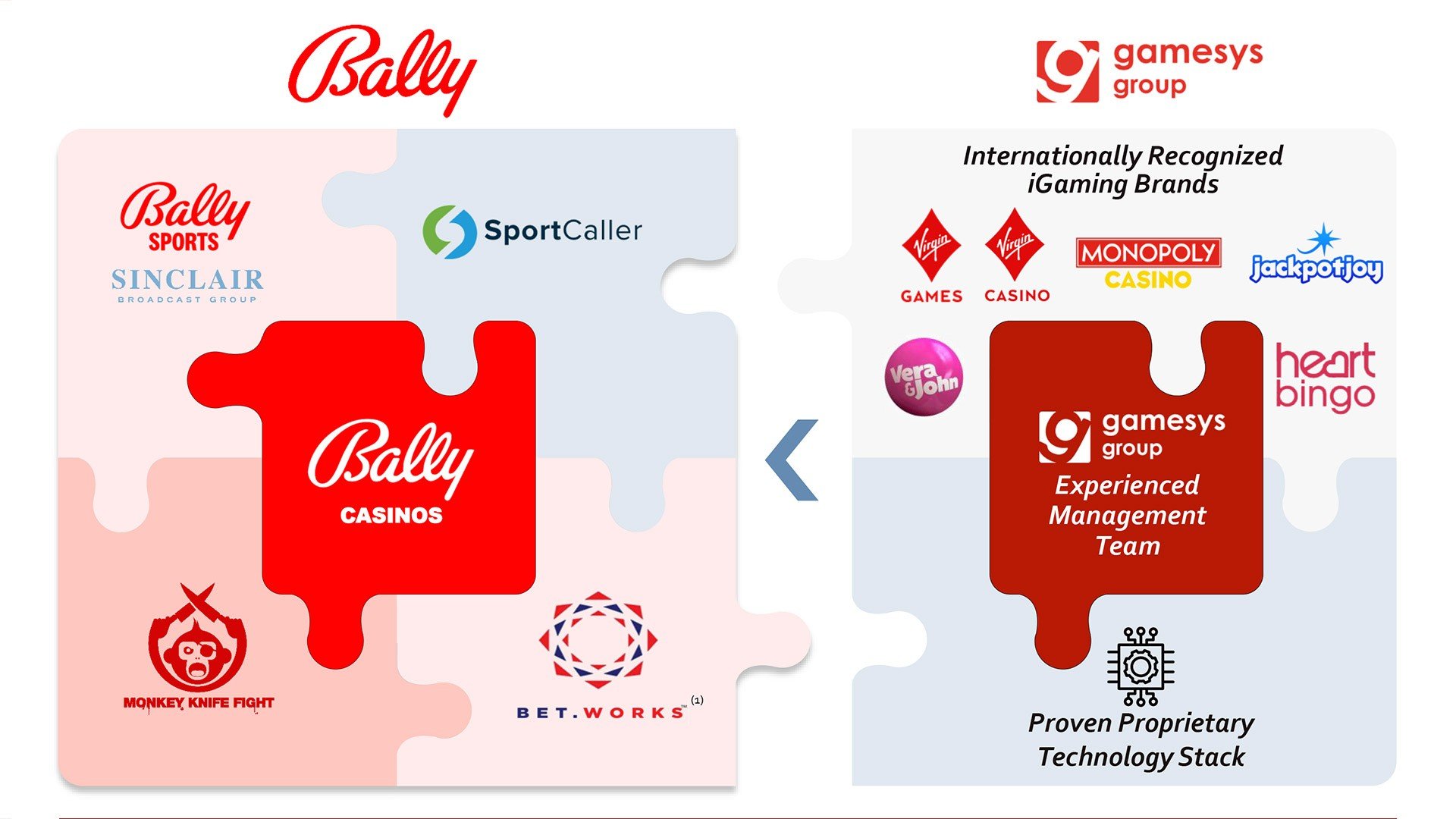

Bally’s $2.7 billion merger with Gamesys became effective on Oct. 1, with all Gamesys issued and to be issued ordinary share capital now owned by Bally’s. Gamesys shares were de-listed and the new Bally’s shares listed on Monday.

The boards of both companies first announced that they had agreed to the terms of a recommended combination on April 13, which was later approved by shareholders in June. The combined entity is expected to be well-positioned to capitalize on the full range of opportunities available both in the US and abroad, stated Bally’s in a September acquisition update.

While Gamesys will benefit from Bally’s land-based and online platform in the U.S., providing market access through Bally’s operations in key states as the nascent iGaming and sports betting opportunities develop in the country, Bally’s will benefit from Gamesys’ technology platform, expertise and management teams across the online gaming field.

“By combining with Gamesys, we will meaningfully accelerate our growth strategy to become a premier, global, omni-channel gaming company, which we believe will create significant long-term shareholder value,” said Soo Kim, Chairman of Bally’s Corporation’s Board of Directors in July.

“Given our comprehensive suite of collective assets and our track record of successfully developing online gaming operations in highly-competitive markets, we believe we will be able to offer customers a unique and differentiated approach to gaming,” said Lee Fenton, Gamesys’ Chief Executive Officer, the same month.

Original article: https://www.yogonet.com/international//noticias/2021/10/04/59598-ballys-board-clears-share-repurchase-increase-to-350m-following-gamesys-acquisition