T

iger Resort, Leisure and Entertainment Inc., operating as Okada Manila, the largest integrated resort in the Philippines, announced Friday a merger with Miami-based special purpose acquisition company 26 Capital Acquisition Corp.

As a result, Okada Manila will become a publicly-traded company following a transaction valuing the enterprise at $2.6 billion and an equity value of $2.5 billion. Universal Entertainment, the parent company of Okada Manila, is rolling 100% of its equity in the company, while 26 Capital Acquisition Corp. is set to provide up to $275 million of cash to the business.

The 26 Capital Acquisition Corp. team is led by Jason Ader, an industry veteran who served as independent director in Las Vegas Sands Corp. from 2009-2016. Upon closing of the transaction, the publicly-traded company will have its common stock listed on the Nasdaq through an American Depository Receipt program.

The boards of directors of both 26 Capital Acquisition Corp. and Okada Manila have unanimously approved the proposed transaction, which is expected to close in the first half of 2022 and is subject to approval by 26 Capital stockholders and other customary closing conditions.

Following the closing of the merger, Okada Manila will continue to be led by President Byron Yip, CFO Hans Van Der Sande and its leadership team. Universal Entertainment Corporation, owner of 100% of its equity, will retain all of its current holdings in Okada Manila in the newly publicly-traded company.

“Universal Entertainment has always taken great pride as the owner and developer of Okada Manila, and we are extremely pleased to partner with Jason Ader and 26 Capital to introduce Okada Manila to the public markets,” said Jun Fujimoto, Chairman, President and Chief Executive Officer of Universal Entertainment Corp. “We look forward to continuing our strong support for the business and to a path of immense growth ahead.”

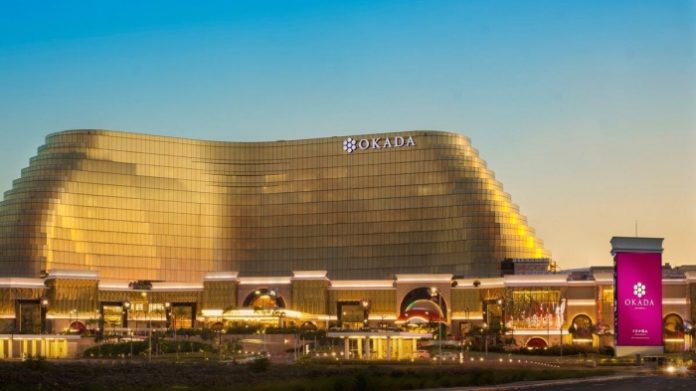

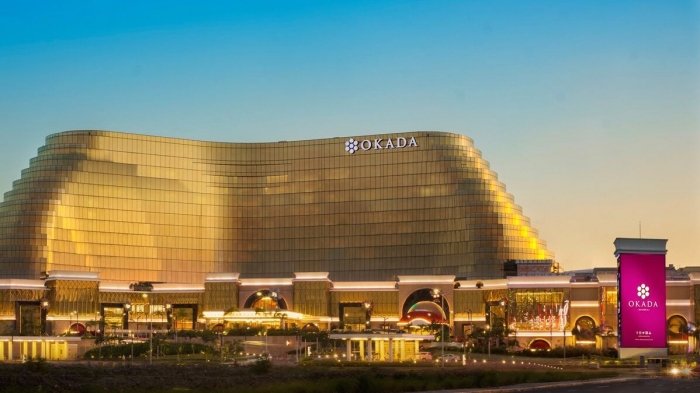

Okada Manila is located in Entertainment City, where the casino gaming market grew 24% annually from 2013-2019 and achieved gross gaming revenue (GGR) in 2019 of over $3.3 billion. It is currently the largest integrated resort in the Philippines in terms of gross floor area and gaming floor area, and the only Japanese-owned and operated integrated resort in the world.

The resort sits on over 50 acres and boasts nearly 35,000 square meters of gaming space, with a capacity to operate 599 gaming tables and 4,263 electronic gaming machines. Upon full completion of construction in 2022, Okada Manila will have licensed capacity to operate 974 gaming tables and 6,890 electronic gaming machines.

Moreover, once fully completed, the resort will feature two towers with 993 luxury hotel rooms, a retail boulevard with capacity for more than 50 shops, a nightclub and indoor beach club, more than 25 dining options, and one of the world’s largest multicolor dancing and musical fountains.

The venue cost $3.3 billion to construct and began to progressively open throughout 2019, following the completion of its first hotel tower. In 2022, following full construction completion, the property will be able to finally operate at full capacity.

The newly announced transaction is expected to allow the company to expand in the country while also giving it the option to “look outside its current market” to other growth possibilities. Okada Manila believes it is set for “tremendous future growth” by tapping into significant pent-up demand after the easing of travel and hospitality restrictions.

“Having 26 Capital as a partner will allow Okada Manila to leverage 26 Capital’s expertise in those areas to help unlock value and drive growth opportunities for the company,” said the company in a press release.

Okada Manila sees future growth prospects in the Philippines’ status as a major tourist destination and its fast-growing gaming market. Moreover, the country “provides a very favorable environment” for gaming businesses relative to competing geographies due to competitive labor costs and no corporate tax for gaming revenue. It also expects to benefit from the newly regulated online domestic gaming market and “potential participation” in a future integrated resort development in Japan.

“Okada Manila is the future of the gaming market in Asia and poised for tremendous growth,” said Jason Ader, Chairman of the Board of Directors and Chief Executive Officer of 26 Capital Acquisition Corp. “With its beautiful new facility, a desirable location in one of the fastest-growing gaming markets in the world, and potential for industry-leading margins and cash flow conversion, I believe the Okada Manila is an extremely compelling investment.”

Original article: https://www.yogonet.com/international//noticias/2021/10/18/59782-okada-manila-to-trade-on-nasdaq-via-spac-merger-valued-at-26b