L

as Vegas Sands has bought buildings in Vegas’ southwest valley for the development of future headquarters. The casino operator purchased two office buildings and a parking garage on Durango Drive, just south of Hacienda Avenue, for $21.55 million in an operation closed last month.

According to a marketing brochure, one office building spans 31,647-square feet, while the other spans 79,109-square feet, reports Las Vegas Review-Journal. Sands completed its exit from the Strip earlier this year by selling The Venetian, Palazzo and the former Sands Expo and Convention Center for a combined $6.25 billion.

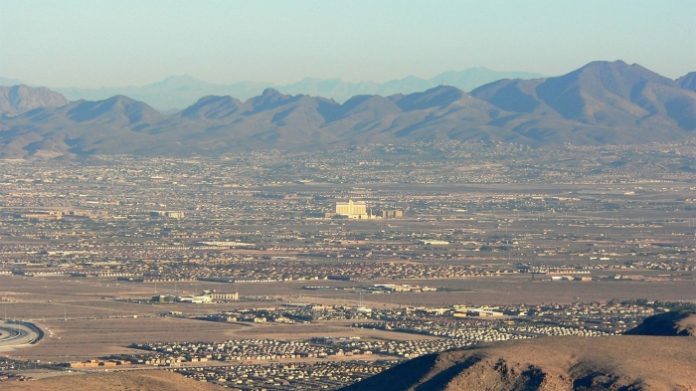

While the company closed its Vegas operations to focus on the Asian market, more precisely Macau and Singapore, the recent move points towards an interest in retaining a certain presence in Southern Nevada. According to Sands spokesman Ron Reese, the newly acquired property will be the company’s future HQ, with a move-in likely to take place in mid-2022.

Reese further told Review-Journal that staffers have already started packing and will be largely out of the offices in The Venetian “by year’s end.” He also noted the new complex is located in a fast-growing area of the valley.

The future HQ office complex was abandoned years ago after its former landlord, Edwin Fujinaga, the former top boss of medical billing collections company MRI International, was imprisoned following accusations of running a Ponzi scheme.

According to court papers from 2015, the complex had sustained “a significant amount of damage, theft and vandalism” throughout these last years: windows and toilets had been smashed, door locks were broken, business documents were strewn all over, and valuable electronics gear was missing. Additionally, most of the landscaping also was dead or deteriorating.

Two Las Vegas real estate firms bought the complex in 2017 for $12 million from a court-appointed receiver and overhauled it. The buildings were painted, the parking lot resurfaced and restriped, and the HVAC system cleaned, among other improvements.

After Sands’ Strip properties were sold to investment firm Apollo Global Management and casino landlord Vici Properties, Chairman and CEO Rob Goldstein remarked “Asia remains the backbone of this company,” earlier this year.

However, Sands operations in the Macau and Singapore markets have seen their fair share of troubles, as seen in its latest quarterly report. The company’s net revenue for Q3, while 92% up versus 2020, still remains far below 2019 levels amid Asian ongoing pandemic-related restrictions.

The company posted net revenue of $857 million, up from $446 million in the prior-year quarter, while below 2019 levels of $3.25 billion, with reduced visitation in both countries to blame. Sands still remains confident to improve its situation following an eventual return of visitors to the two markets.

Original article: https://www.yogonet.com/international//noticias/2021/10/22/59877-sands-buys-two-buildings-in-vegas-southwest-valley-to-develop-headquarters