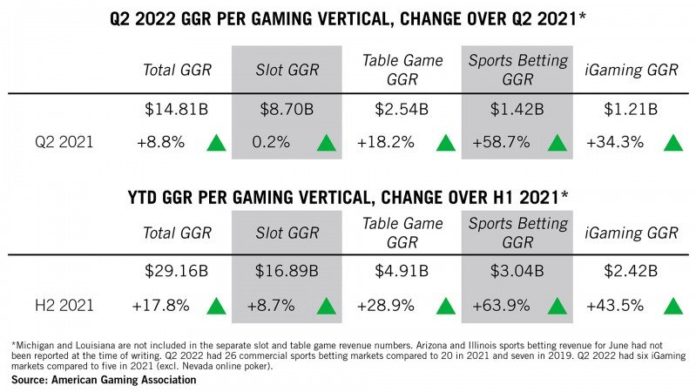

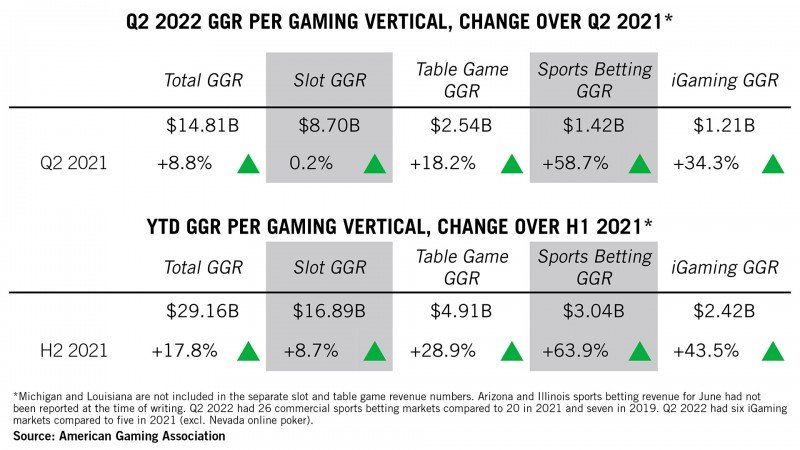

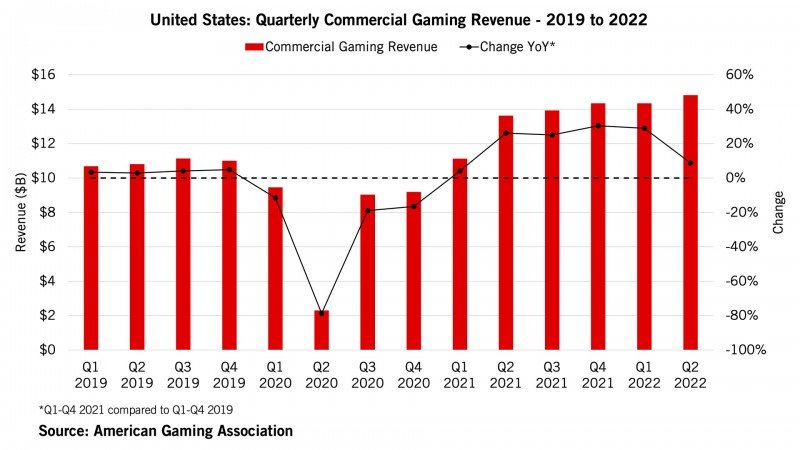

The US gaming industry keeps breaking records. Nationwide commercial gaming revenue for the second quarter totaled $14.8 billion, according to the American Gaming Association’s (AGA) Commercial Gaming Revenue Tracker. Despite the growth rate softening throughout the period, the amount still sets a new quarterly all-time high for the industry, beating Q4 2021 by 3.3%.

Commercial gaming revenue in the country has delivered $29.16 billion through the first half of the year. This is nearly 18% above year-over-year from H1 2021, and further positions the US industry on pace to set a new annual record for a second consecutive year.

“Q2’s results mark a 16-month period of gains for commercial gaming,” said AGA President and CEO Bill Miller. “With increasingly difficult year-over-year comparisons, our strength through the first half of 2022 reflects sustained consumer demand for legal options as well as gaming’s record popularity.”

Throughout the period, the industry continued to benefit from strong consumer demand for travel and entertainment, as well as the slow return of business travel and conventions. Travel spending nationwide rose for three consecutive months in Q2 and set a new pandemic high of $105 billion in June, according to the U.S. Travel Association.

But despite the impressive results, the industry’s growth rate softened throughout Q2, with the pace of monthly year-over-year gains slowing from 13.1% in April to 10.7% in May, and 2.5% in June. This demonstrates stabilizing consumer demand and increasingly challenging year-over-year comparisons, the American Gaming Association says.

As for how this growth was experienced on a state-by-state basis, 22 of the 31 commercial gaming jurisdictions operating during the same period last year posted revenue increases in Q2. Furthermore, nine states delivered all-time quarterly highs: Arkansas ($152.0M), Iowa ($483.6M), Maryland ($519.5M), Massachusetts ($383.3M), Nevada ($3.71B), New York ($1.02B), Oklahoma ($39.6M), Oregon ($11.4M) and Pennsylvania ($1.32B).

Through the first half of 2022, gaming revenue in 27 of 31 commercial jurisdictions is ahead of the same period in 2021. Three states are trailing slightly behind last year –Kansas (-1.3%), Mississippi (-3.7%) and South Dakota (-2.5%)– reflecting “a faster-than-average” return to normal operations in 2021 and tougher year-over-year comparisons. Additionally, the District of Columbia’s “turbulent betting market” is down 26.7% compared to H1 2021, AGA says.

Growth in all verticals

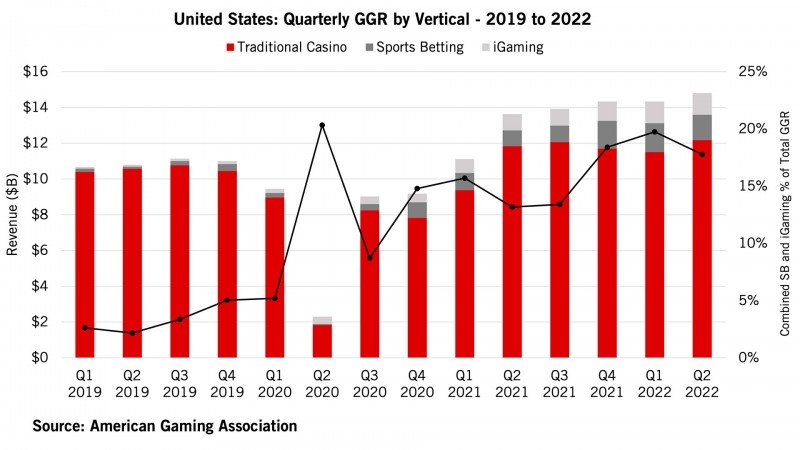

Traditional casino gaming continues to drive the industry’s success: both brick-and-mortar slots and table games saw quarterly revenue all-time highs in Q2. While slot machine revenue was up a slight 0.2% Y-o-Y, revenue from table games jumped a whopping 18.2%, “indicating the lingering impact that Covid restrictions had on table games in the first half of 2021.”

At the state level, 17 of 25 traditional casino gaming states had combined revenue from slot and table games increase in the second quarter. The slowdown in the remaining markets mostly reflects tougher comparisons in these jurisdictions due to Covid restrictions having eased earlier compared to in other places.

Traditional casino revenue is tracking ahead of 2021 in 21 of 25 states through the first half, while four states are trailing slightly: Kansas (-1.3%), Louisiana (-0.3%), Mississippi (-3.4%) and South Dakota (-2.8%). And on a nationwide basis, traditional casino gaming in H1 generated $23.67 billion in revenue, 11.7% ahead of the first half of last year.

![]()

This success can also be seen in the sports betting sector, which continues to grow. Strong consumer demand, coupled with six new state market launches over the last year, put the vertical up 58.7% from Q2 2021; and the $3.04 billion in sports betting revenue thus far in 2022 is up by a notable 63.9% Y-o-Y increase.

While the start of summer and a slower sports calendar brought with it the expected annual slowdown in sports betting activity, commercial sports betting “remains on track for another record-setting year,” AGA believes. Eleven of 20 commercial sports betting markets that were operational one year ago saw wagering revenue growth in the second quarter.

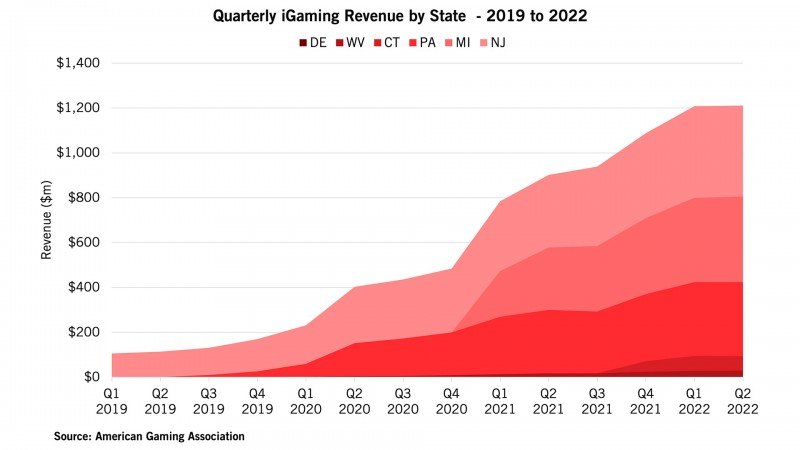

Meanwhile, the six operational US iGaming markets –Connecticut, Delaware, Michigan, New Jersey, Pennsylvania and West Virginia– generated $1.21 billion in Q2 2022, narrowly beating the vertical’s previous record, which was set in Q1 this year.

And with the addition of one market, the $2.42 billion in commercial iGaming revenue generated through June marked a 43.5% jump over the same period in 2021 – the vertical’s highest-grossing year. Additionally, same market revenue gained 35.7% compared to H1 2021.

“While on pace to set an annual revenue record, we are cognizant of the continued impacts of inflation and labor challenges as well as marketplace concerns of potential recession,” said Miller. “Our members have proven their agility and resilience over the last two years and are well-positioned to face these potential headwinds heading into the second half.”

AGA’s Q2 2022 commercial gaming revenue report comes on the heels of the National Indian Gaming Commission’s announcement earlier this week that tribal operators generated an all-time high of $39 billion in gaming revenue in 2021. Combined with commercial gaming’s $53 billion in revenue, 2021 beat the previous record held in 2019 by 13%.

“Tribal gaming demonstrated its responsible leadership throughout the pandemic and these record results reflect that commitment,” concluded Miller. “The full recovery and ongoing success of tribal casinos go well beyond the casino floor to support vibrant communities across the country.”

See AGA’s full Commercial Gaming Revenue Tracker Q2 results here.