OddsJam is a sports betting startup that provides API resources to operators and media companies on the B2B side, as well as educational content and betting tools on its B2C approach. Last week, it acquired odds comparison platform OddsBoom, whose founder Mark Knight joined OddsJam’s executive team as Head of Product.

OddsJam’s proprietary data coverage of 75+ sportsbooks results in the processing of over 1 million odds per second, allowing more than 200,000 monthly unique users to view real-time odds across virtually all leagues and betting markets, including player props, alternate lines, in-play markets and futures.

Yogonet caught up with Alex Monahan, OddsJam Co-Founder, who explained the new capacities and resources the company has after the acquisition and new appointment, and analyzed the new market opportunities in the U.S., with California and Ohio taking the lead.

“Data is truly the beating heart of the industry,” he notes, as he describes his ambition to further build a data-driven sports media company focused on original content and odds-comparison tools.

Why have you decided to invest in the acquisition of odds comparison platform OddsBoom now? What will this translate into in your B2B and B2C offerings in the short term? How do you plan to see a return from this investment?

The impetus of our decision to acquire OddsBoom was multifaceted but it really all boiled down to Mark (Knight). He’s been a true innovator in the space and in our opinion, his technology and product skills are second to none. He also has experience working in a number of countries, having previously deployed successful affiliate companies in Europe and Australia. Quite simply, we wanted to work with him. Our overarching thought was, why build adjacent sports betting products independently when we can join forces and hopefully build the best products together? Now that Mark is leading product for OddsJam, we’re already hard at work with an eye toward football season. On the B2C side, we’re striving to level up our game across the board – content, betting tools, odds comparison – so sports bettors have everything they want throughout the season. And Mark’s relationships with international operators should help open new B2B doors as well. We’re already seeing returns via increased site traffic and subscriptions as well as B2B revenue.

What are the new capacities, resources and opportunities this move is opening up in the mid-term? What’s the differential and added value from an industry veteran such as Mark Knight as head of content, and how do you plan to leverage this addition?

Both our medium- and longer-term product roadmaps are filled with a variety of new and useful odds comparison tools for sports bettors. Having Mark and his team onboard is going to allow us to move faster and more efficiently through each phase of the build process, from ideation through implementation. Some features are already nearing completion while others have formally launched, including a parlay builder tool that significantly reduces the friction of determining which book has the best price for a custom parlay. That’s one example, with a lot more in the pipeline.

Which are your best-performing markets (both in terms of gaming verticals and also of jurisdictions) today, and which ones do you plan to target next?

It probably won’t come as a surprise but the biggest US markets are performing best for us, with Northeast states like New York, Pennsylvania and New Jersey at the top of the list. While California is obviously the state everyone has their eye on, we’ll have to wait and see how the ballot initiatives there shake out come November. In the meantime, we’re looking forward to the launch of Ohio in January. That market looks to have a lot of potential. Sports betting is our only gaming vertical at the moment but we plan to expand into online casino products and content going forward.

Which kind of companies would you prioritize in terms of potential further acquisitions, or new partnerships? How would you describe your current business relationship with sportsbook operators?

The greater US online gaming space is still nascent and there are new players emerging every day, be it operators, affiliates, startups etc. So while I’m sure there are plenty of platforms and products that could be good fits vis-a-vis potential M&A and partnerships, our current focus is 100% on building the best possible product. In terms of operators, we’ve built strong working relationships with nearly all operators in the industry, including B2B relationships with some of the top sportsbooks in the US.

Bet365 recently said it will launch a new sports betting news website in the coming months, and on the retail front, FansUnite’s Betting Hero is launching a sports betting concierge program at a Philadelphia’s sports bar with Bankroll. Are you seeing any trend from gaming operators, regarding educational betting content? Who would you consider your business competition today, both B2B and B2C?

That’s fantastic news, and frankly refreshing to hear. I don’t think there’s any doubt that the terminology and various processes required to get started with sports betting can be daunting to many. I remember my first bet. It was quite confusing and scary, and I’m sure millions of other Americans have had a similar experience. Because of that, the onus is absolutely on all industry stakeholders to prioritize educational content, as that’s the only way we’re going to create a thriving and mature sports betting market. Most operators are doing their best to address that need through different forms of onboarding videos and articles, and we continue to strive to lead from ahead in that respect, publishing content on a daily basis aimed at helping sports bettors of all types build their knowledge base. While most affiliates and data providers could be classified as competition for us, our primary competitors are the Action Network and WagerTalk.

You said the company seeks to build the most data-driven media company in the sports betting industry. What technologies, R&D and innovations could you mention with that goal in mind? Could you share some examples that reflect ongoing progress in that sense?

It goes without saying, but data represents the core of the entire sports betting ecosystem. From the leagues selling their official data to global providers like Sportradar, to those firms then contracting with the operators so they can price and roll out expansive betting menus for consumers to engage with, data is truly the beating heart of the industry. The tech that we’re working tirelessly to improve and optimize is all centered around harnessing all that data and presenting it to users in the fastest and most seamlessly consumable way possible. We’ve only been around for just over a year but we’re making non-stop improvements to the amount of data we show, the speed in which it’s purveyed as well as the tools we’ve created to help users make sense of it all.

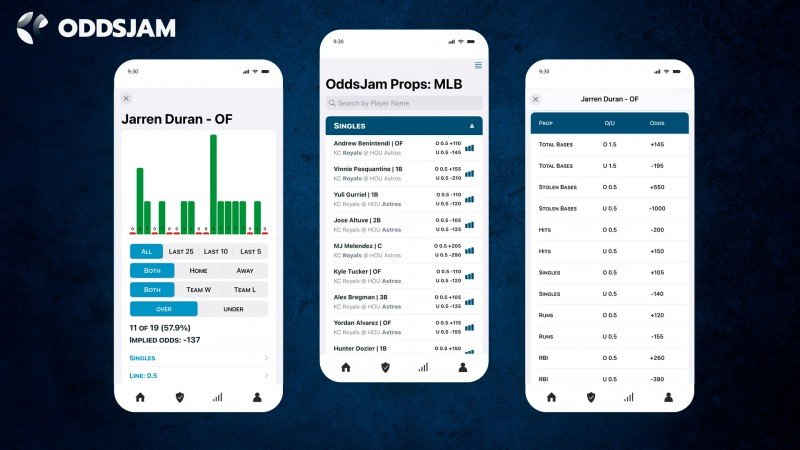

OddsJam recently launched a mobile app that enables users to conduct personalized player prop research. Could you share any initial results and feedback on this app? What are the differential features there?

We’ve seen great success with the app so far. It’s free and monetized against the CPA model, so we’re obviously trying to cast a wider net in terms of the types of bettors we hope can leverage it. And while we certainly have a lot to improve, we believe it’s fulfilling a need similar products have not been able to, as it allows users to parse and filter historical data to uncover relevant insights around specific prop bets they may be considering.

Nevada and New Jersey are showing efforts towards upgrading the esports betting landscape, and many predict this could be the future. What role does esports play in your business performance? What’s your approach and strategies to be competitive in this area? What have you learned so far from the esports bettor culture, and how do you plan to engage with these communities?

Esports isn’t a huge focus for us, but given its growing popularity and the fact that some DFS operators are already offering it, we’re nonetheless gearing up to add esports odds from all major sportsbooks in order to appeal to as wide of a range of audiences as possible. Once we begin to implement esports products, we’ll be able to start gauging how impactful they could be to our business. Regardless, we’re approaching that vertical with the same attention to detail as every product we build.