PointsBet is doubling down on its US strategy and defending the marketing and sales cost of its expansion in the region. The Australian bookmaker’s commitment to the market comes despite having recorded its second straight year of losses on Wednesday, as the Melbourne-born business reported that year-on-year losses increased 42.6% to AUD 267.7 million ($183.7 million) for the year ended June 30, 2022.

The company’s share price fell more than 11% after the release of the report, which underscores PointsBet’s costly US strategy. The group spent about AUD 240 million ($162.8 million) in sales and marketing, with AUD 162 million ($109.9 million) pumped into the US alone, according to The Sydney Morning Herald. The company sees North America as the key market for betting due to its population size, sports structure, and tech investment.

Chief executive Sam Swanell told investors that while the aggressive marketing and sales spend would not continue in 2023, it was a “necessary” set-up cost to become the seventh-biggest operator in North America, at a 3.7% of market share. The company is currently operational in 11 US states, plus Ontario in Canada, up from seven in the past year.

“Their sports are set up for betting, there are more breaks in play, more sports and a sizable population. All the logic indicates this is a once-in-a-lifetime opportunity for this billion-dollar industry,” he further said, as reported by Morning Herald. “It’s up to $13 billion on the existing states, just wait till states like California and Texas with big populations legalize.”

While group revenue rose 52.3% to AUD 296.5 million ($208 million), most of the additional win from sports betting and iGaming was swallowed by the increased cost of sales and marketing, especially in the US market. This aggressive spending is not uncommon there, with PointsBet’s competitors having also deployed similar tactics in an effort to increase market share.

Swanell also defended the company’s achievements in the US thus far, stating PointsBet has the right partnerships and licenses in the states it needs to. “It’s taken investment, but we’re there now, and we have an opportunity to capitalize,” he said, as the company targets further expansion for next year.

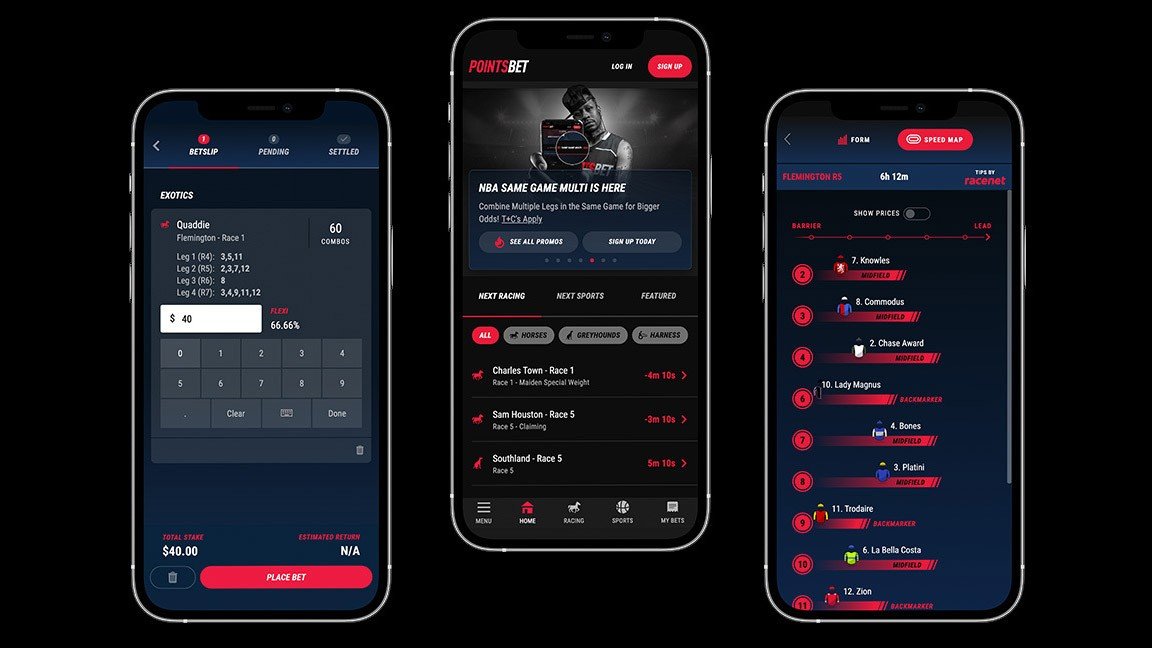

The chief executive sees a potential triumph card in how PointsBet has customized its offering for major North American sports such as NFL, NBA, baseball and hockey. According to Swanell, no one has really developed in-play live betting products for these sports as PointsBet has. “That’s where our right to win is,” he said.

According to the executive, PointsBet’s US growth would begin in New Jersey, where the company’s arm is expected to turn a profit by the end of this year. In the meantime, the bookmaker is entering new states, including a launch last Thursday in the newly regulated market of Kansas, where it has market access through Kansas Crossing Casino in Pittsburg.

Swanell pointed to PointBet’s division for its home market of Australia as a sign that the company might achieve success in a mature jurisdiction. In that country, the trading business achieved year-on-year net revenue growth of 30%, and its third year of annual EBITDA positivity. And with the racing season right around the corner, the brand will be refocusing there with “some things” for the sport, which is the one that contributes the most revenue in Australia.

PointsBet’s US push will also see the company launch a betting newsletter, a new move unveiled this week. With editorial guidance from PointsBet senior editor Teddy Greenstein, the newsletter will be sent three times a week (Sunday, Monday and Thursday) at first, with plans to eventually expand to five times per week. It could provide the company a much-needed cheaper alternative to accrue and engage customers at a point in which it needs to cut spend.

See PointsBet’s full results for the fiscal year here.

Original article: https://www.yogonet.com/international/news/2022/09/01/64068-pointsbet-commited-to-us-expansion-despite-losses-widening-yearonyear