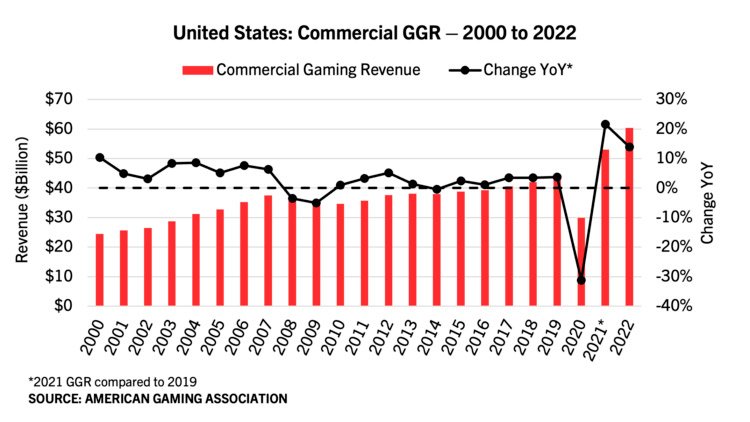

US commercial gaming topped $60 billion in 2022, breaking its annual record for a second consecutive year, the American Gaming Association announced on Wednesday. Both the traditional and online verticals saw all-time revenue highs for the twelve-month period.

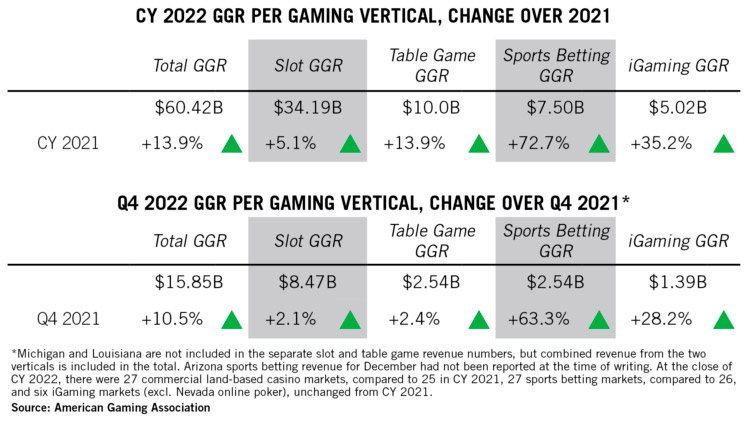

Total revenue from all forms of gaming amounted to a record $60.4 billion, according to the trade group’s Commercial Gaming Revenue Tracking, marking the first $60 billion year for the commercial gaming sector. The figure broke the previous record of $53 billion, set in 2021, through an almost 14% increase.

The year was punctuated by all-time high quarterly commercial gaming revenue of nearly $15.9 billion in Q4 2022, AGA noted in a press statement. Sports betting and iGaming both marked single-quarter highs, while traditional gaming grew 1.7% year-over-year.

“Our industry significantly outpaced expectations in 2022,” said AGA President and CEO Bill Miller. “American adults are choosing casino gaming for entertainment in record numbers, benefiting communities and taking market share from the predatory, illegal marketplace.”

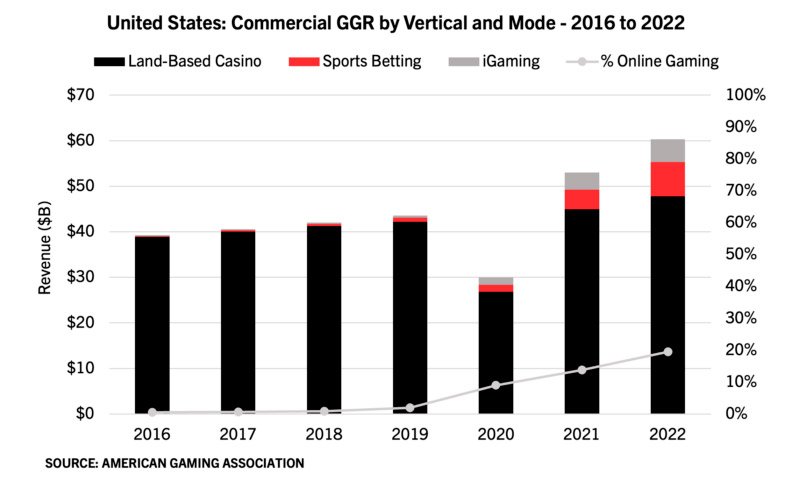

The American Gaming Association noted that the industry continues to diversify its offerings, with land-based gambling accounting for 80.5% of total revenue for the year and online gaming making up the remaining 19.5% — marking a new high for the vertical.

The association provided insights for each gaming vertical. As for traditional gambling, 84 million American adults (34% of the adult population) visited a casino in the past year, including new markets in Nebraska and Virginia. Table game revenue saw a strong boost in demand, up almost 14% year-over-year, while slot machines showed steady 5.1% annual growth.

As for sports betting, the continued growth of the legal market in 2022 drove new records for handle ($93.2 billion) and sportsbook revenue ($7.5 billion). This growth was fueled in part by Kansas, which operationalized both retail and mobile sports wagering; and the launch of mobile sports betting in Louisiana, Maryland and New York, with the latter now the top US market.

Lastly, online casino revenue also grew in 2022. The vertical saw a revenue jump of 35.2% year-over-year to $5 billion in the limited number of legal iGaming states. Notably, iGaming’s growth came without any new states launching in 2022.

AGA noted that the portion of overall US gaming revenue derived from iGaming remains low in comparison to other major international markets such as the U.K. (65%), France (29%) and Germany (28%). At the state level, however, the combined share of online sports betting and iGaming in the four states that offer both retail and full online gaming options averaged 40.7%.

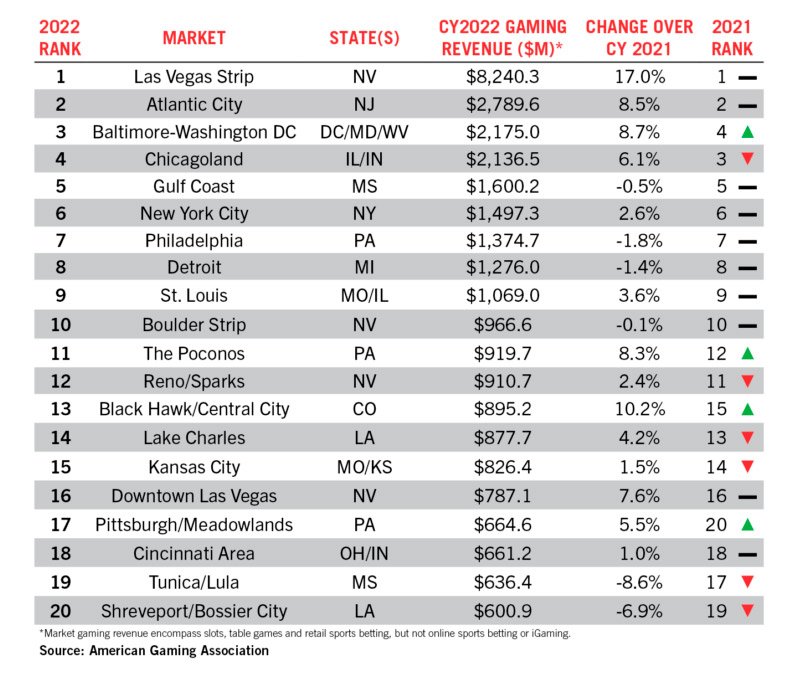

Thirty-two gaming jurisdictions saw an increase in revenue compared to 2021, with 29 states setting new annual records. Mississippi (-3.6%) and South Dakota (-2.2%) saw revenue contract compared to 2021, which can be attributed to tougher year-over-year comparisons after dropping pandemic restrictions faster than other states. Additionally, the sports betting-only market in Washington, D.C. continued to lose ground to neighboring Maryland and Virginia.

In 2022, the Las Vegas Strip and Atlantic City retained their top commercial market positions. The Baltimore-Washington, D.C. market reclaimed its position as the nation’s third largest gaming market, besting Chicagoland (fourth) and the Mississippi Gulf Coast (fifth), which round out the top five.

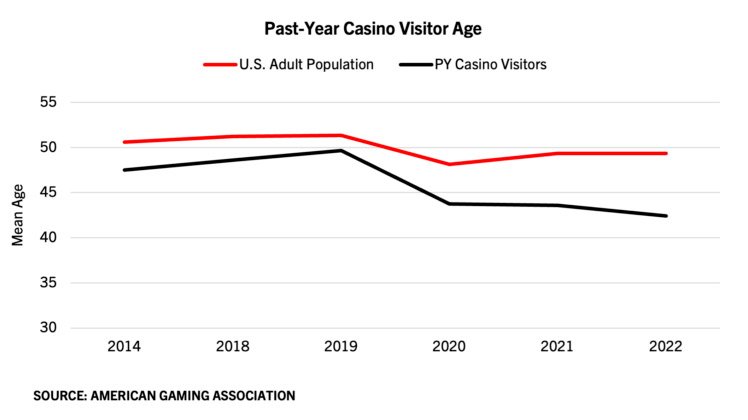

What is surprising, though, is that despite concerns, the average age of adult Americans visiting casinos has decreased since the start of the pandemic, trending increasingly younger than the adult population overall. The average age of a casino patron was 42.4 years old, down from 43.6 in 2021 and 49.6 in 2019.

The pandemic not only shifted casino visitor demographics but has also produced a more gaming-oriented mix of consumers, claims AGA. Compared to pre-2020, fewer people are visiting casinos mainly to take advantage of non-gaming amenities, while more are now splitting their time between gaming and other entertainment offerings.

“Even as we navigate macroeconomic headwinds, I am optimistic about the year ahead,” continued Miller. “To carry our momentum into 2023, the AGA remains focused on combating the illegal market, doubling down on responsibility, and creating favorable policy and regulatory conditions that enable our industry’s sustained success.”

The record year for US commercial gaming came despite persistent concerns about the financial health of American consumers. What’s more, total annual US gaming revenue for the past year will likely exceed $100 billion for the first time once the National Indian Gaming Commission reports tribal gaming revenue for 2022 later this year.

Original article: https://www.yogonet.com/international/news/2023/02/16/66134-us-commercial-gaming-tops-60b-for-a-first-time-in-2022-up-14-from-previous-high