Flutter reported on Thursday full-year 2022 core profit at the lower end of its forecast range. The news sent the shares of the company, currently the world’s largest online betting firm, as much as 6% lower, despite Flutter’s fast-growing US FanDuel unit outperforming expectations.

The Paddy Power, Betfair and PokerStars owner said annual core profit excluding the US grew 4% to £1.29 billion ($1.55 billion) versus the forecast range of £1.29 billion to £1.39 billion. Flutter’s London-listed shares were 5.1% lower at 12,790 pence, making it one of the top losers in the FTSE All-Share index, notes Reuters.

Explaining the results, the firm noted that customer-friendly sports results, including Argentina’s win and the starring roles of Kylian Mbappe and Lionel Messi at the World Cup, cost nearly £40 million in December. Meanwhile, revenue at the Australian Sportsbet business was 6% lower as punters gambled less once Covid-19 lockdowns were over.

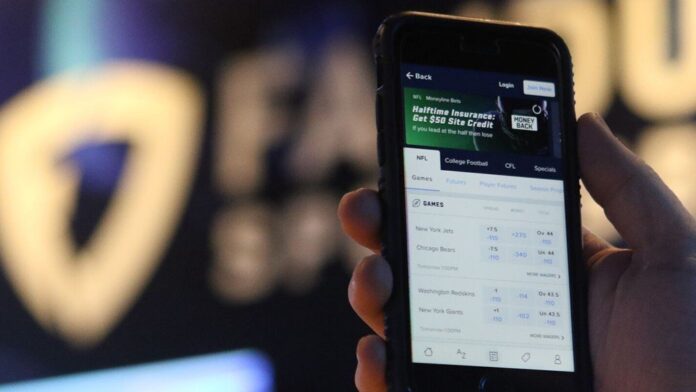

However, momentum continued to grow at FanDuel. Flutter’s US revenue was up a whopping 67% to $3.2 billion, coming at the top end of its outlook range, which was upgraded in November. The US operation made a core loss of $313 million, compared with expected losses of $300 million to $360 million.

“Flutter delivered a strong performance in 2022, continuing to execute on the strategic priorities we outlined,” said Peter Jackson, Chief Executive Officer at Flutter. “Growth in our recreational customer base delivered 2022 revenue growth of 27% and we ended the year with a record 12.1 million average monthly players in Q4.”

The US revenue hike follows many reports from Flutter that its FanDuel business remains firmly on track to be profitable for the first time this year. The brand grew its leading share of the US sports betting market to 50% from 42% at the end of September.

Meanwhile, FanDuel’s slice of the iGaming market slightly rose to 21% from 19%, and the company also had a record Super Bowl, on top of acquiring over 1.2 million customers so far this year. The brand is now the number one operator in 15 of the 18 US states where sports betting is live.

Back in November, Flutter said it sees FanDuel’s revenue jumping to around $15 billion over the long term, with the overall value of the sports betting and iGaming market expected to rise to $40 billion by 2030 from $9 billion at the current time.

Management highlighted the positive US results, with Jackson reaffirming the company has “an unparalleled number one position” in the country, where FanDuel delivered its “most successful launches to date” in Maryland and Ohio.

Explaining the company’s performance elsewhere, Jackson noted that, outside the US, Flutter was “pleased” with its performance but that it faced regulatory changes and challenging comparatives. “We are well placed to build on gold medal positions in our mature markets while we are delivering very strong growth in a range of attractive high-growth markets,” the CEO said.

During the analyzed period, the company added major Italian market player Sisal to its brand portfolio. The betting firm has also recently announced that it was exploring an additional US listing of Flutter’s ordinary shares that could yield “a number of long-term strategic and capital market benefits,” and management now confirmed it has begun consultation with shareholders. Early feedback has been “supportive.”

“2023 is off to a pleasing start driven by positive momentum from the end of last year. With our combined US business on track to deliver a positive EBITDA for the full year 2023 for the first time, the group is currently at an earnings’ transformation point and we look forward to delivering future growth,” the company’s Chief Executive concluded.

Original article: https://www.yogonet.com/international/news/2023/03/02/66288-flutter-posts-fullyear-2022-profit-at-lower-end-of-guidance-fanduel-outperforms-at-67-revenue-hike