Boyd Gaming announced Friday that its Board of Directors has authorized an additional $500 million under the operator’s share repurchase program. “Considering the additional authorization, the company had approximately $633 million remaining in repurchase authority as of March 31,” said the firm.

The news of the additional $500 million share repurchase program was unveiled in conjunction with the declaration of a quarterly cash dividend of $0.16 per share, payable July 15 to shareholders of record as of June 15.

In the first quarter, the company, which runs 28 gaming venues across 10 states, bought back about $106 million worth of its own shares. It had $263.5 million in cash on hand as of March 31, confirming the strength of its balance sheet.

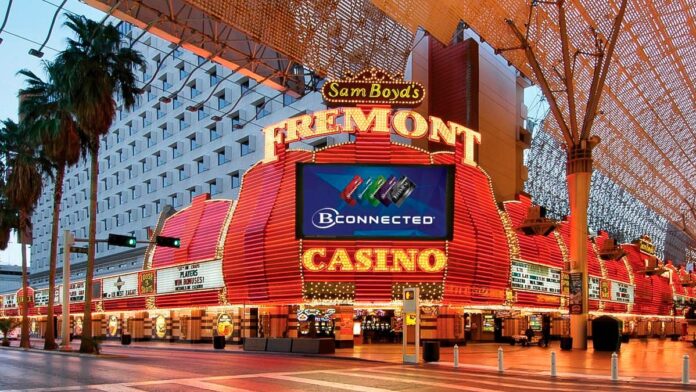

Boyd's Fremont Hotel & Casino

The company has been buying its own stock for some time now. Friday’s buyback announcement comes 11 months after the firm revealed another $500 million repurchase plan, which in turn follows the announcement of a $300 repurchase effort in October 2021.

Boyd has previously indicated that it intends to buy back approximately $100 million of its shares per quarter. If no further buyback authorizations are added by that time, by late 2024 the gaming operation will have repurchased $1.3 billion worth of its own shares, a significant percentage of its market capitalization of $6.9 billion.

The announcements also build upon strong Q1 results, unveiled late last month. During the first three months of the year, the operator saw revenue of $964 million – a 12% year-on-year increase. The solid performance was driven by strong Nevada results, growth in the online segment, and California’s Sky River Casino operating stronger than expected.

Original article: https://www.yogonet.com/international/news/2023/05/10/67088-boyd-announces-new-500m-share-repurchase-plan-declares-quarterly-cash-dividend-of-016-per-share