U.S. commercial gaming industry recorded $16.07 billion in revenue in the second quarter fueled by a significant surge in demand for online gaming.

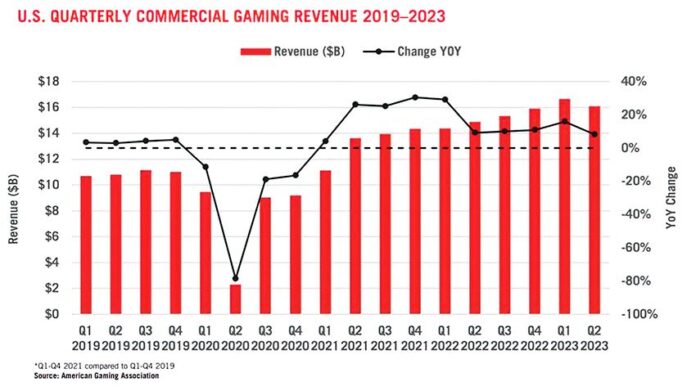

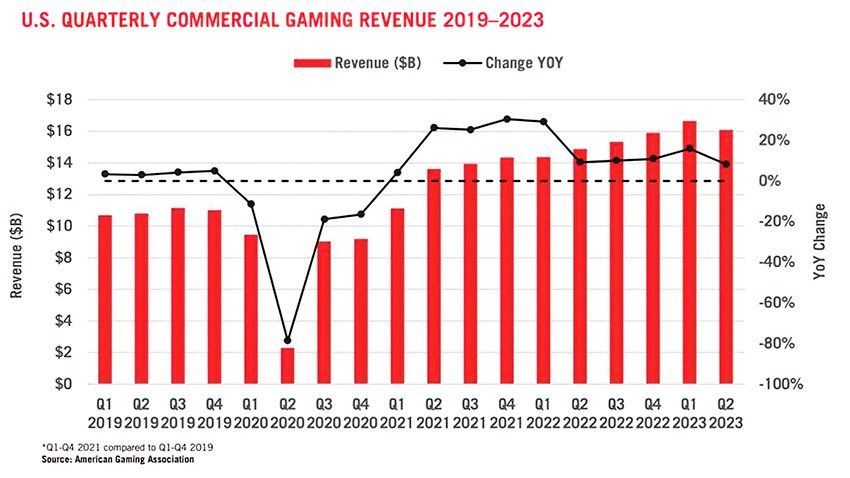

Revenue from commercial gaming, encompassing traditional casino games, sports betting and iGaming together helped the industry surpass the $16 billion mark for a consecutive second quarter. The three-month period marked the industry’s second highest-grossing quarter ever and the tenth consecutive quarter of annual growth.

Nationwide gaming revenue grew at 8.1% year over year in Q2 compared to 16% annual growth in the first quarter when the industry set a new quarterly high at $16.6 billion, reveals data compiled by the American Gaming Association. In the second quarter, the growth in total gaming revenue was fueled by the online gaming verticals – particularly online sports betting – while land-based gaming was relatively flat.

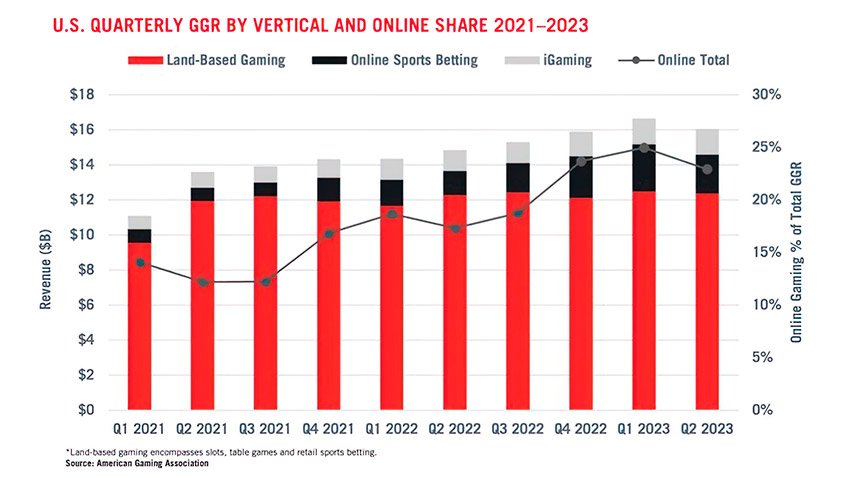

In the second quarter, the growth in total gaming revenue was fueled by the online gaming verticals – particularly online sports betting – while land-based gaming was relatively flat.

Online gaming revenue surged 43.1% year-over-year as online sports betting and iGaming revenue reached $3.68 billion in total. Online revenue expansion was mainly driven by the introduction of online sports betting in Kansas, Maryland, Massachusetts, and Ohio within the past year.

Although a lighter sports betting calendar led to a sequential decline in the online share of overall gaming revenue from Q1, online sports betting and iGaming still accounted for 22.9% of quarterly commercial gaming revenue.

Quarterly revenue generated by land-based gaming – casino slots, table games and retail sports betting – reached $12.38 billion, essentially flat from the first quarter (-0.3%). Annual growth slowed to 0.9 %, down from a pace of 7.0% in Q1 and 1.6% in Q4 2022.

Through June, gaming revenue was pacing 11.9 percent ahead of the same period in 2022, totaling $32.71 billion.

At the state level, 23 of 34 commercial gaming jurisdictions that were operational one year ago increased Q2 revenue from 2022. Among gainers, two states – Massachusetts and Virginia – marked all-time records for a single quarter due to the recent inception of sports betting and land-based casino respectively. Florida, Indiana, Iowa, and Mississippi reported quarterly revenue contraction of between -1.6 and -6.2%, while Washington, D.C. dropped -9.1% as the small sports betting-only market continued to lose ground to neighboring Maryland and Virginia. Other states with revenue declines in Q2 fell by less than a percent.

The expansion of gaming revenue has led to a windfall in taxes for state and local governments in commercial gaming states. In Q2, commercial gaming operations paid an estimated $3.62 billion in direct gaming taxes to state and local governments. Estimated Q2 gaming tax revenue growth of 9.6 percent outpaced the 8.1 percent growth in gaming revenue. This is reflective of quarterly growth that was dominated by sports betting and iGaming – verticals that are on average subjected to higher tax rates.

Boosted by the opening of new commercial casinos in Illinois, Nebraska and Virginia, traditional casino gaming generated quarterly revenue of $12.27 billion from slot machines and table games in Q2. Second-quarter revenue from traditional land-based gaming grew 0.9% year-over-year while falling just short of the single-quarter record set in Q1 (-0.3%).

Second-quarter sports wagering revenue jumped 56.6% year-over-year to $2.30 billion, a new Q2 record. Of the quarterly total, $347.1 million was generated in states that weren’t operational one year ago: Kansas, Massachusetts and Ohio. Excluding new markets, quarterly sports betting revenue was up 33.0 percent year-over-year.

The iGaming vertical continued its robust growth with $1.48 billion in Q2 revenue, up 22.6 percent compared to Q2 2022 and tying Q1 for a single-quarter record. At the state level, iGaming set new quarterly revenue records in Connecticut, New Jersey, Pennsylvania, and West Virginia.