Madrid gambling trade groups have released a new report which shows that in 2023 gaming in the autonomous community recovered to pre-pandemic levels and that most companies in the sector have managed to overcome the complex financial situation brought by COVID.

The Fifth Report on Gaming in the Community of Madrid was shared by the Madrid Association of Recreational Businessmen (AMADER), the Association of Companies of Gaming and Leisure Establishments of Madrid (AEJOMA), and the Association of Authorized Gaming Companies (ASEJU).

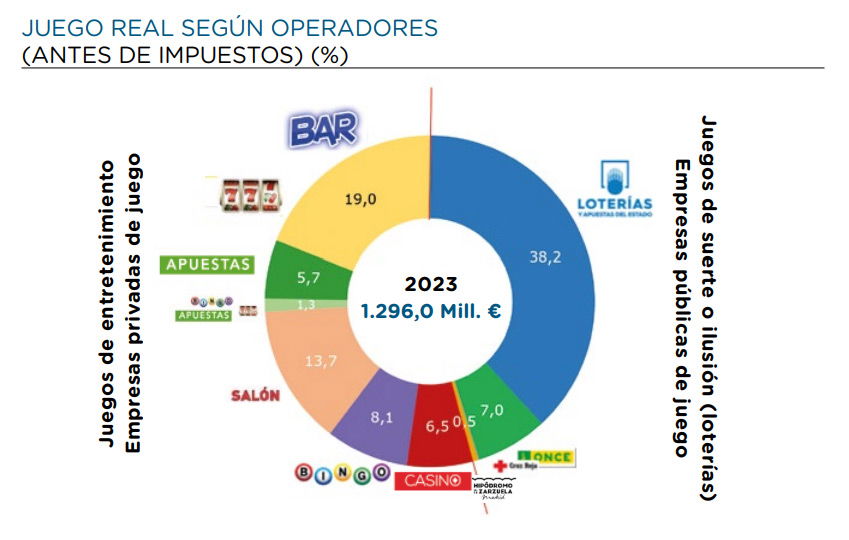

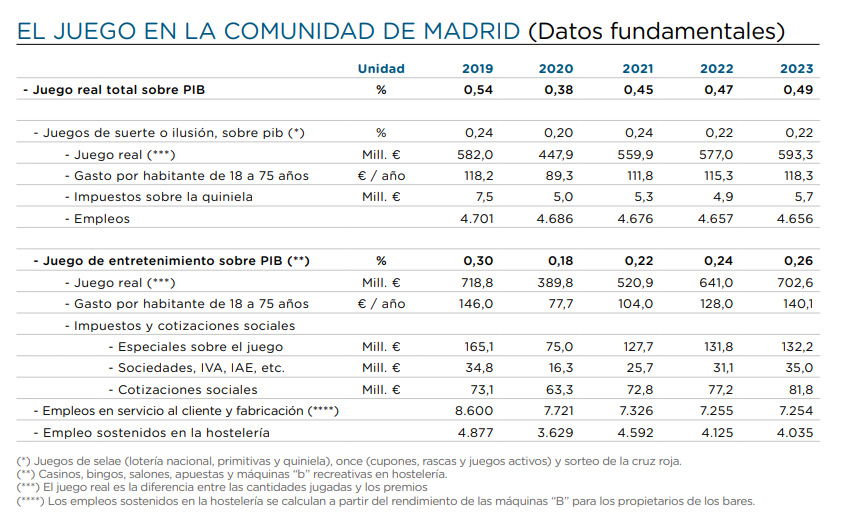

According to the figures, in 2023, gaming amounted to EUR 1,296 million (USD 1,399 million), adding all amounts allocated to games of chance and entertainment. This meant a return to the gambling levels of 2018 and 2019, with spending per inhabitant aged between 18 and 75 of EUR 118.3 (USD 127.7) per year on lotteries, pools, coupons, and scratch cards from the Spanish National Organisation for the Blind (ONCE) and EUR 140.1 (USD 151.5) per year on entertainment games.

According to the report, it should be noted that the real amount that a company allocates to gambling is the difference between the amounts played and the prizes.

During 2023, 35.4% of the income of entertainment gaming companies was allocated to taxes and social contributions, which meant “a return to pre-Covid normality,” according to data from CREA Sociedad de Garantía Recíproca, based on the Central Commercial Registry. This generated EUR 132.2 million in special taxes on gambling, EUR 35 million in general taxes on companies, and EUR 81.8 million in social security contributions.

Economic impact

The report also showed that the impact of gambling in the economy of the Community of Madrid represented 0.5% of its GDP in 2023: 0.22% corresponded to games of chance of public companies such as Loterías y Apuestas del Estado (SELAE) and ONCE and 0.26% to entertainment gambling managed by private companies.

However, there are sectors that have suffered the impact of COVID-19 and the changes it has induced, including the closure of betting rooms and premises, and the decrease in operating machines in the hospitality industry. This has produced a decrease in the number of jobs supported by gambling. For this reason, according to the report, pre-Covid employment levels have not yet fully recovered.

Prizes and controls

Concerning prizes, in lotteries and coupons around 50% of the amounts played are distributed, while in arcade games, entertainment games, such as bingo, arcades and machines in the hospitality industry, at least between 70% and 80% are given out. Some machine games reach 80 or 85%.

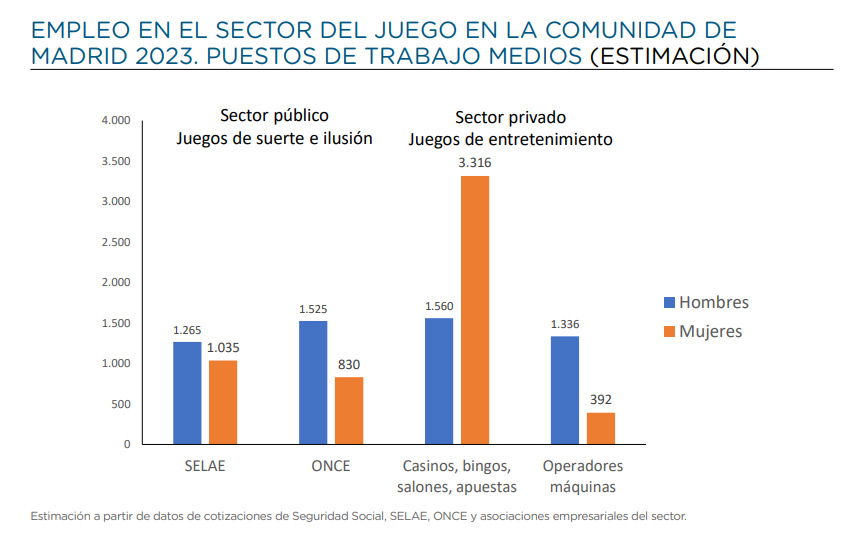

In terms of employment, entertainment gaming directly employed 7,254 people, mainly in customer service, management and equipment design/manufacturing positions. Indirectly, it supported 4,035 jobs in the hospitality sector, through the performance of the gaming machines installed in bars. In total, the gaming sector generated 17,139 direct and indirect jobs in the Community of Madrid.

The report also offers insights on the controls carried out by the Administration of the Community of Madrid, through its General Subdirectorate of Gaming Regulation, and the National Police, which seek to ensure that the industry complies with regulations.

In 2023, 27,232 inspections were carried out, with which, according to the Minister of Environment, Interior and Agriculture, “the gaming industry is respecting the regulation.” Additionally, it was reported that the application of automatic entry controls has been an effective method in preventing the access of minors or self-excluded persons and that making these installations involved an investment for the lounge and betting companies of EUR 8.1 million.

Decrease in the gaming offer

Another major point of the report is that the gaming offer in the Community has been showing a reduction: the impact of COVID and the excess of premises resulted in the closure of betting shops and premises above market demand, and the decrease in traditional bars (owned by self-employed people) has reduced the offer of “B” recreational machines.

Since 2019, the number of lounges has decreased by almost 40, and the number of bars authorized to have “B” machines by almost 3,000. This implies a rationalization of the offer as premises with low profitability disappear.

Find out more details about this report at this link.