Millennials continue to drive the highest levels of participation across gaming channels in the US, TransUnion‘s latest U.S. Betting Report shows. They account for 57% of high-value online bettors, those spending $500 or more per month. This insight is the result of an online survey of 3,000 adults conducted from late April to early May 2024.

“As we’ve found in prior reports, the majority of betting consumers can afford this form of entertainment,” said Declan Raines, head of TransUnion’s gaming business. “Having a significant bump in income was the primary correlating factor to whether consumers bet, regardless of income level. This suggests most consumers only wager what they can well afford to lose.”

Differences between online and land-based bettors

Consumers who bet online and in land-based casinos appear to have a financial advantage, compared to non-bettors. For example, 20% of online bettors and 18% of land-based bettors indicated their incomes increased a lot within the past three months—compared to just 4% of non-bettors. Similarly, 55% of online bettors and 58% of land-based bettors have good or excellent credit scores, while only 50% of non-bettors said the same.

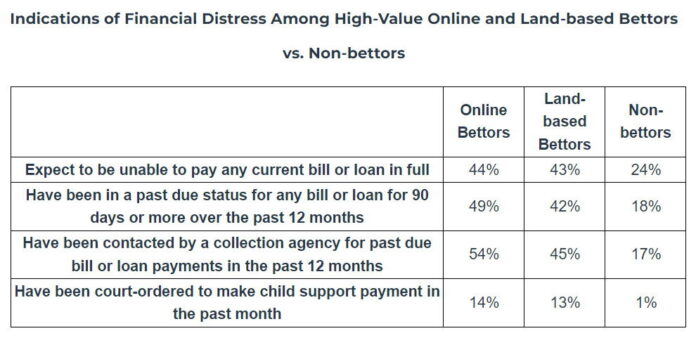

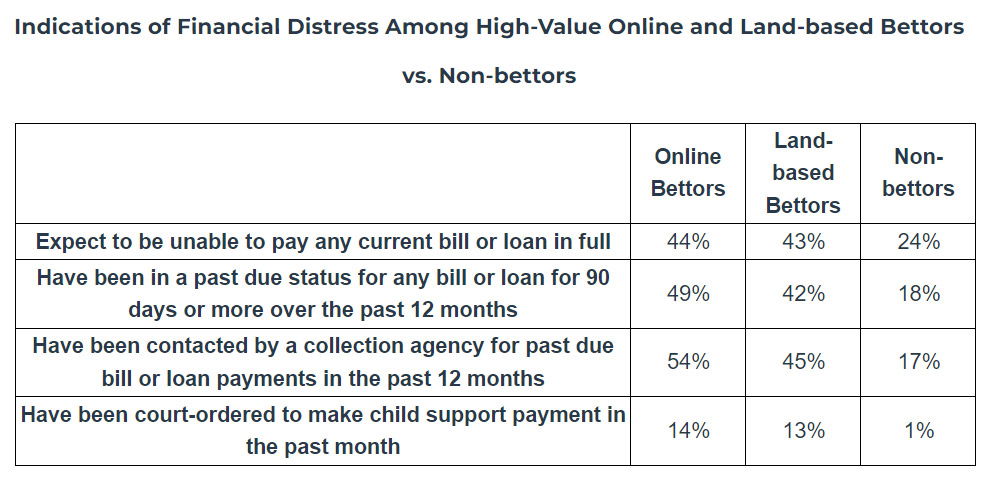

While income and credit scores were higher among bettors, patterns indicating poor financial management also emerged for this cohort. This was more pronounced among high-value bettors.

Heightened scrutiny ahead

As the market matures, operators can anticipate increased scrutiny from the media, with questions focused on the perceived social drawbacks of widespread betting. Other gaming markets such as the UK and Australia have experienced similar cycles leading to increased regulatory requirements around responsible gaming.

US state regulators are already evaluating how best to improve consumer protections while striking the difficult balance between state tax revenues and the risk of pushing consumers to unregulated and offshore providers.

Operators may likely face increased requirements to assess responsible gaming risk for their customers. To do this, additional data sources that provide insights into consumer financial health will need to be considered to ensure proactive identification.

“Operators are keenly aware of the need to balance commercial performance with player protections,” said Raines. “The crucial next step will be to demonstrate proactive measures that protect consumers to regulators and consumer advocates.”

“This can be achieved by leveraging their vast first-party data, combined with consumer insights, which together can help them proactively identify high-risk players without introducing unnecessary friction to the majority of consumers who play within their means.”

To read the full U.S. Betting Report, click here.

Original article: https://www.yogonet.com/international/noticias/2024/08/13/75110-nearly-6-out-of-10-gamblers-betting-500-or-more-per-month-online-are-millennials-says-study