In the rapidly evolving world of iGaming, the choice of payment solutions plays a crucial role in shaping the user experience, driving conversion rates, and determining overall business success. A well-chosen payment system not only facilitates smooth transactions but also builds trust, encourages player retention, and enhances a website’s competitiveness. Conversely, poor payment processes can result in high abandonment rates, reduced revenue, and damaged player relationships.

iGaming solutions provider Uplatform recognizes the need for flexible, region-specific solutions. Their platform features over 550 payment systems to meet the unique demands of different markets. At the SBC Summit in Lisbon, stand S112, Uplatform will showcase how their tailored solutions can help operators grow their businesses and enhance player satisfaction.

Understanding the payment landscape: Why it matters

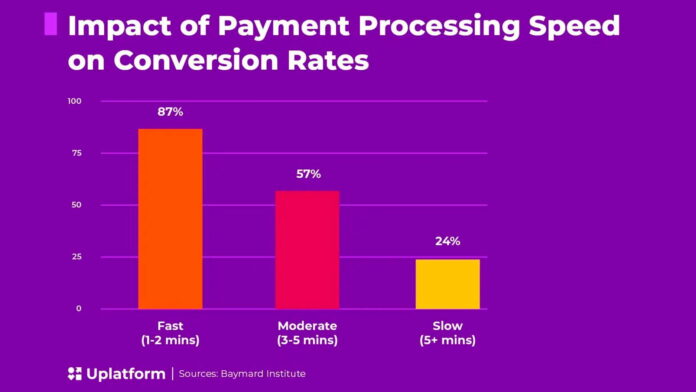

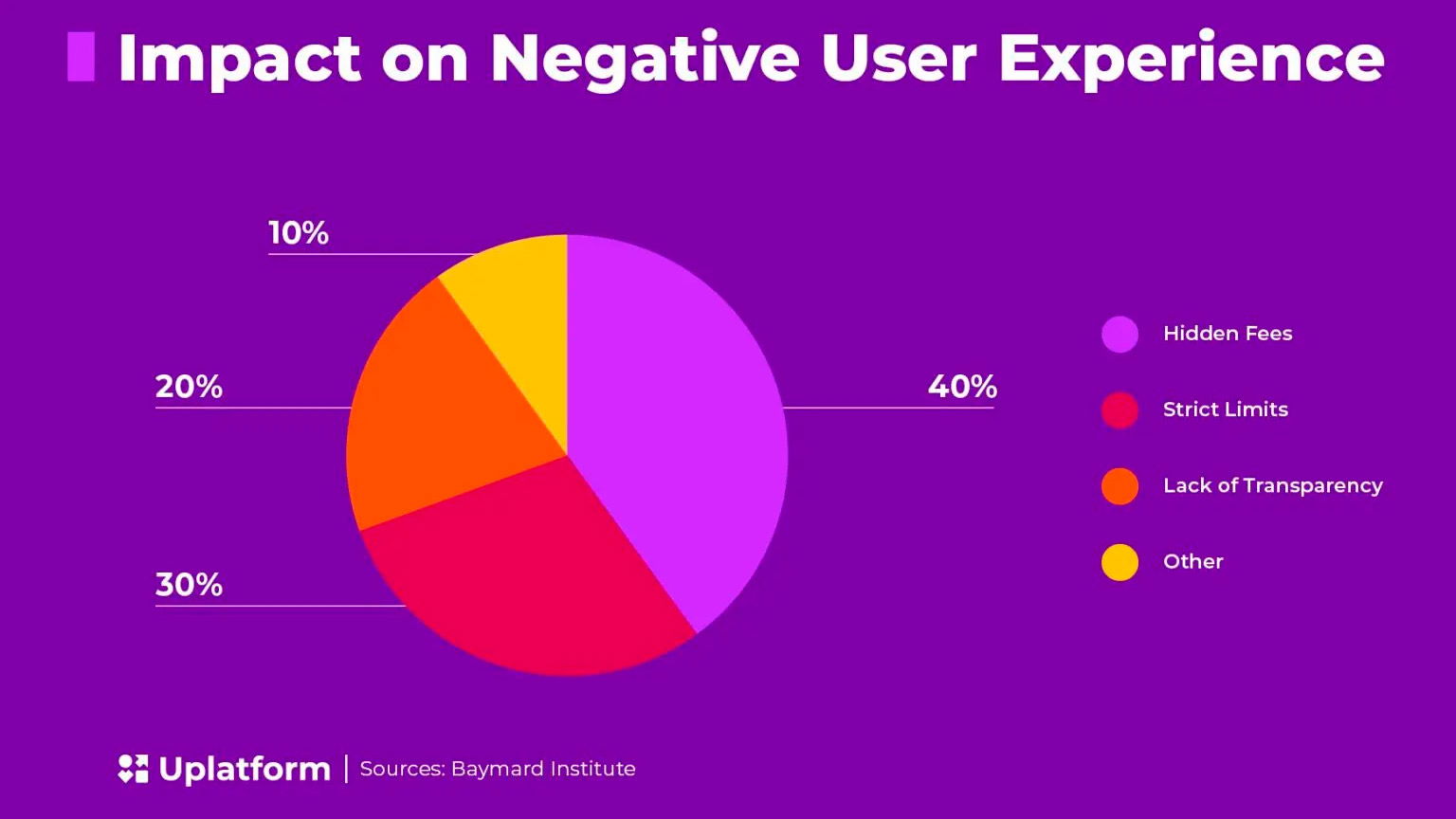

Payment solutions are a pivotal aspect of the overall user experience in iGaming. When players encounter familiar, fast, and reliable payment methods, they are more likely to complete transactions and return to the website. In contrast, if players struggle with payment options that are unfamiliar, slow, or costly, they may abandon the process altogether.

A global perspective on payment preferences

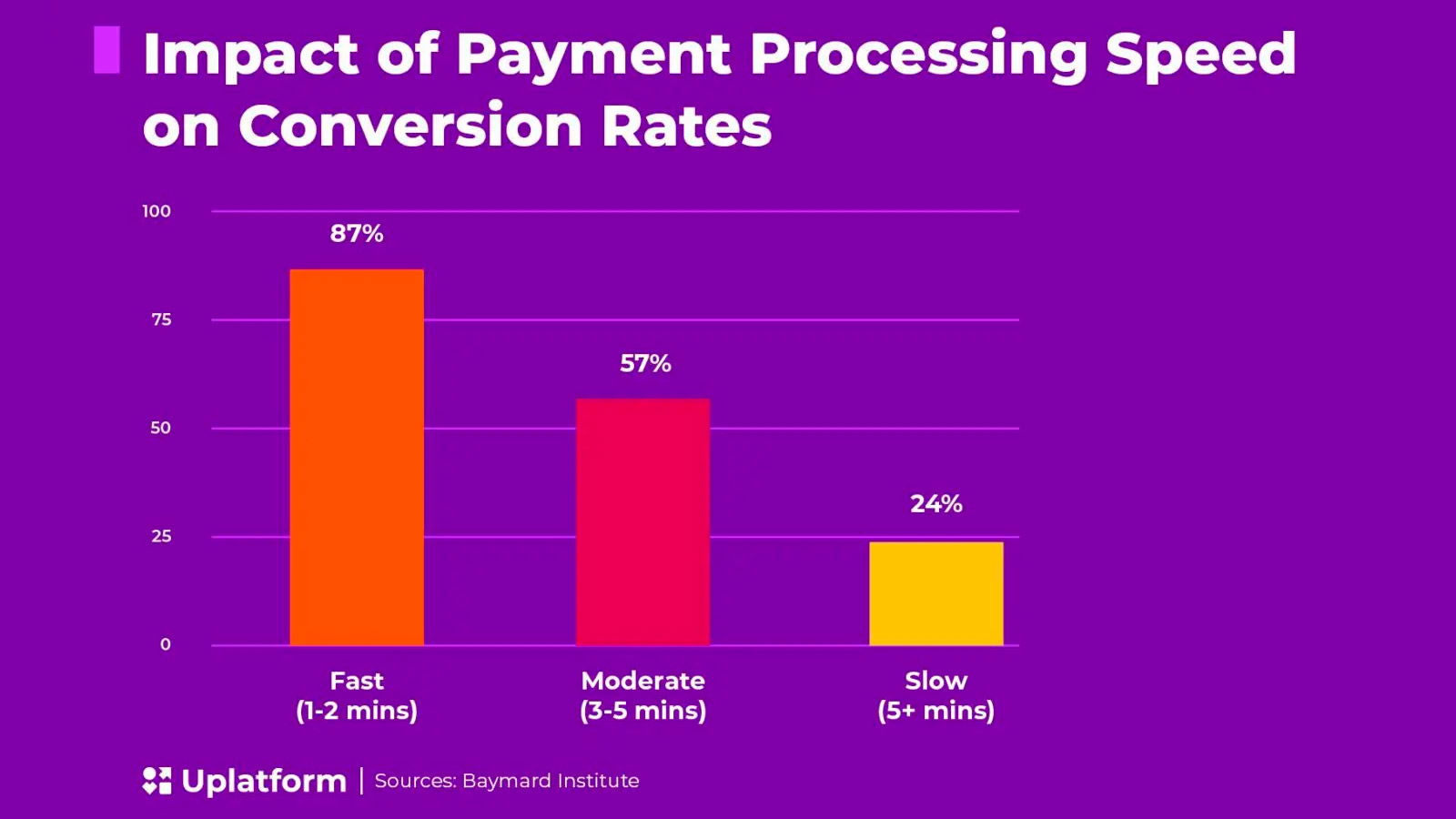

Globally, payment preferences vary significantly. In Europe, bank transfers and credit cards dominate, while in Latin America, cash-based systems and local e-wallets are more common. In Africa, mobile money is the preferred method due to its accessibility, while in Asia, players often opt for e-wallets and alternative payment methods.

The variety of payment methods is a crucial element for attracting and retaining players, directly impacting their experience and overall platform engagement. According to Eduard, Payments Business Development Manager at Uplatform, “It’s important to focus on the most popular payment methods, which may be just 2-3 options and will vary by country.” By strategically offering the most relevant payment options, operators can enhance user convenience, boost conversion rates, and increase their platform’s competitiveness.

Aligning payments with market demands

Success in any market hinges on offering payment options that align with local player preferences. When players encounter familiar and trusted payment methods, they are more likely to deposit funds, remain engaged, and even bring new registrations. Localization is, therefore, a critical component of any payment strategy. By tailoring payment solutions to the habits and preferences of local players, operators can build trust and drive higher conversion rates.

A successful payment strategy begins with a comprehensive understanding of regional payment preferences. Uplatform helps identify the most popular methods in each market. For example:

- In Germany, bank transfers like Sofort or Giropay are widely preferred.

- In Portugal, payment systems such as Mbway and Multibanco dominate.

- In India, platforms like UPI and Paytm lead the market.

Uplatform’s success team offers ongoing support, both before and after launch, providing in-depth insights into local payment trends and guiding the integration of the most effective methods. With tailored recommendations and optimization of payment interfaces, Uplatform ensures that payment solutions are aligned with the specific demands of each market, helping operators engage players effectively and grow their business.

Regulatory compliance

Navigating the complex web of local financial regulations is one of the most challenging aspects of payment optimization. Each country has unique financial rules, AML (Anti-Money Laundering) requirements, and payment processing standards. Compliance with these regulations is essential for maintaining smooth operations and building player trust.

For example, in Brazil, operators must adhere to specific regulations on transaction limits and reporting, while in Japan, stringent KYC (Know Your Customer) checks are required before payments can be processed. Failing to comply with these regulations can result in severe penalties, including fines or the loss of operational licenses.

Localized payment options

Providing localized payment methods is essential for attracting and retaining players. Each region has specific preferences:

- In Brazil, players favor Boleto Bancário for cash-based payments and local e-wallets for online transactions.

- In Japan, convenience store payments and credit cards are commonly used.

- In Nigeria, mobile money services like Paga are the preferred method.

Uplatform’s comprehensive selection of over 550 payment methods ensures that operators can meet the needs of players in any region, helping them grow their player base and loyalty. Uplatform’s localization guide also offers useful tips and recommendations for adapting payment solutions to specific markets.

Variety of payment methods: A key element for attracting and retaining players

The variety of payment methods offered by operators is essential for attracting new players and retaining existing ones. A diverse range of options—such as bank cards, e-wallets, cryptocurrencies, and local payment systems—ensures that players can find a method that is convenient and familiar.

This accessibility not only enhances the user experience but also directly impacts conversion rates and overall competitiveness. When players encounter their preferred payment options, they are more likely to deposit funds and stay engaged. Conversely, the absence of suitable payment methods can lead to abandoned transactions and lost revenue, highlighting the critical role of a well-rounded payment strategy.

Uplatform ensures operators can offer a diverse range of payment methods that cater to the specific preferences of target markets. This variety helps attract new players and retain existing ones, supporting website growth and success.

Efficient payment integration

Integrating payment solutions can be resource-intensive, but it’s essential for optimizing the user experience and maximizing conversion rates. Operators often face a trade-off between aggregators, which offer access to multiple payment methods through a single integration but tend to charge higher fees, and direct integrations, which can be more cost-effective but are often slower to set up. Smaller operators may also struggle to secure direct partnerships with some payment providers due to lower transaction volumes.

A balanced approach is crucial for long-term success. Uplatform recommends combining direct integrations for key payment methods with aggregator services to achieve both cost efficiency and broad coverage. A phased approach to integration is also recommended, starting with high-impact payment methods and gradually adding others to optimize resource allocation and revenue potential.

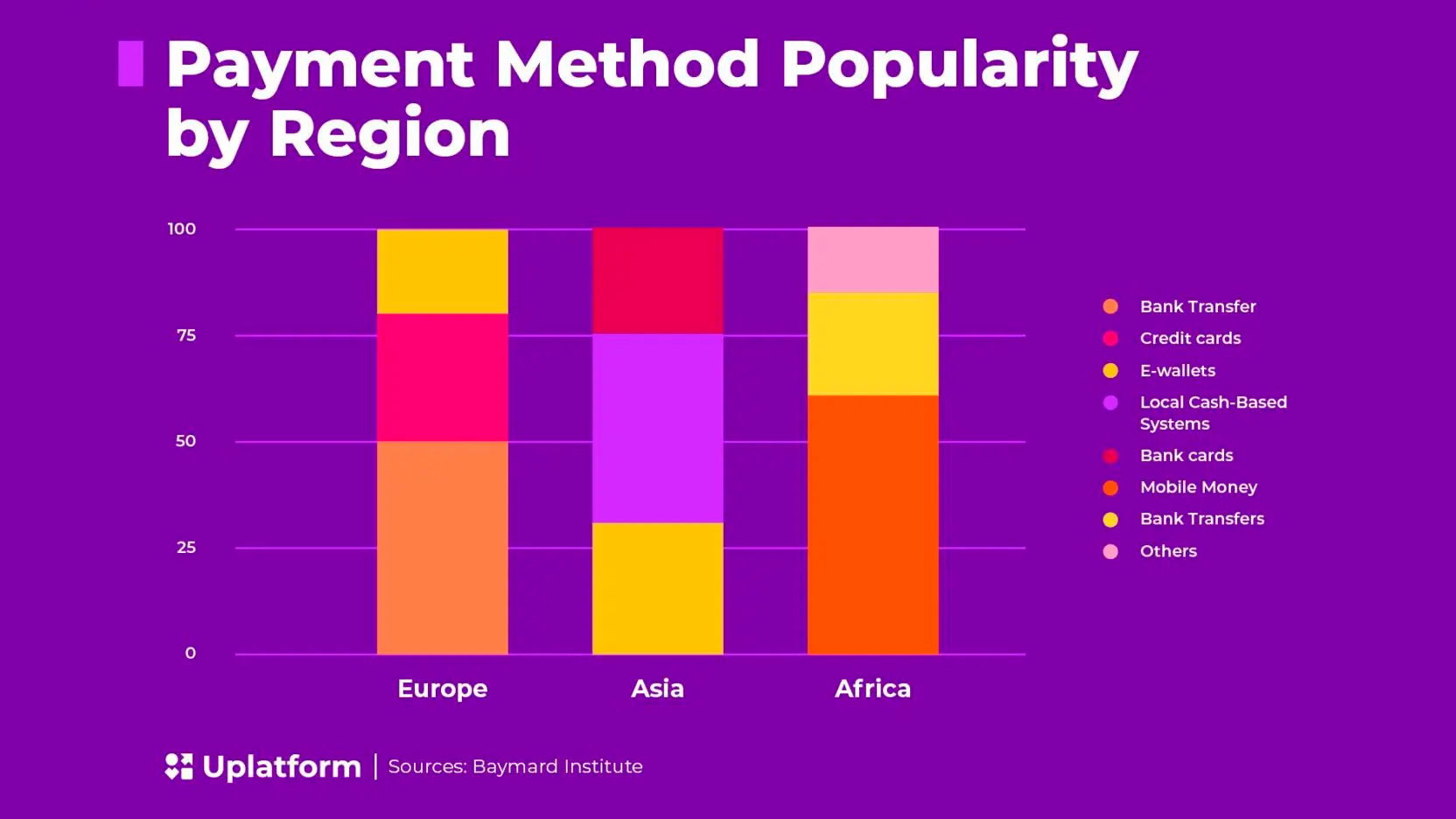

Player-centric design

The design of the payment interface plays a crucial role in whether or not players complete transactions. A cluttered or confusing payment page can drive players away, while a well-designed, intuitive interface encourages them to complete their transactions.

To optimize the user experience, it’s essential to structure payment methods effectively. Group options into clear sections (e.g., bank cards, e-money, mobile operator payments) and use recognizable icons and logos to visually distinguish them. A clean, organized layout helps players quickly find their preferred method, enhancing conversion rates and overall satisfaction. Using iframe payment windows, which keep the player on the same tab, can improve the user experience and boost conversion rates by up to 30%.

By improving the UI/UX of payment pages, operators can create a more seamless and enjoyable experience for players, increasing engagement and retention.

Geo-based payment sorting

Geo-based sorting ensures that players see the payment options most relevant to their geographic location, increasing trust in the brand and encouraging transactions. On multi-geo sites, geo-sensitive sorting is crucial. Simply implementing geo-based sorting can increase conversion rates by up to 80%.

For example:

- In Europe, players are likely to prefer bank transfers or credit card payments.

- In regions with high mobile penetration, prioritizing mobile money solutions can lead to better engagement

By showing players familiar options, Uplatform helps operators increase trust and grow conversion rates.

The role of cryptocurrency

The rise of cryptocurrency in iGaming offers new possibilities for operators. While cryptocurrencies like Bitcoin offer fast, anonymous transactions, they are not universally accepted. Uplatform helps operators evaluate whether crypto is the right fit for their target markets.

In markets where cryptocurrency is widely accepted, integrating it into the payment system can build trust and improve conversion rates. However, in regions where crypto is less understood, it may not be the most effective option.

How Uplatform helps

Uplatform has a proven track record of helping operators implement effective payment methods across diverse markets. With over 550 payment systems, Uplatform provides tailored, high-conversion solutions that align with each market’s unique preferences and regulations.

Uplatform’s experience ensures that operators have access to the top-performing payment methods in each region. Whether entering new markets or localizing an established brand, Uplatform’s expertise helps operators succeed and grow their businesses.

Original article: https://www.yogonet.com/international/noticias/2024/09/23/79643-the-role-of-payment-solutions-in-driving-conversion-in-igaming