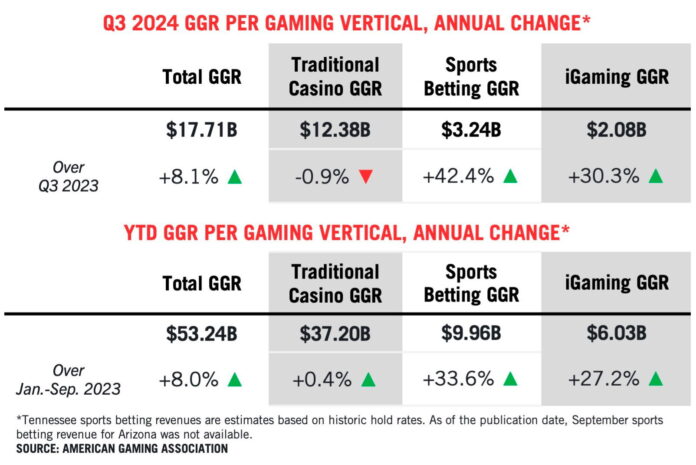

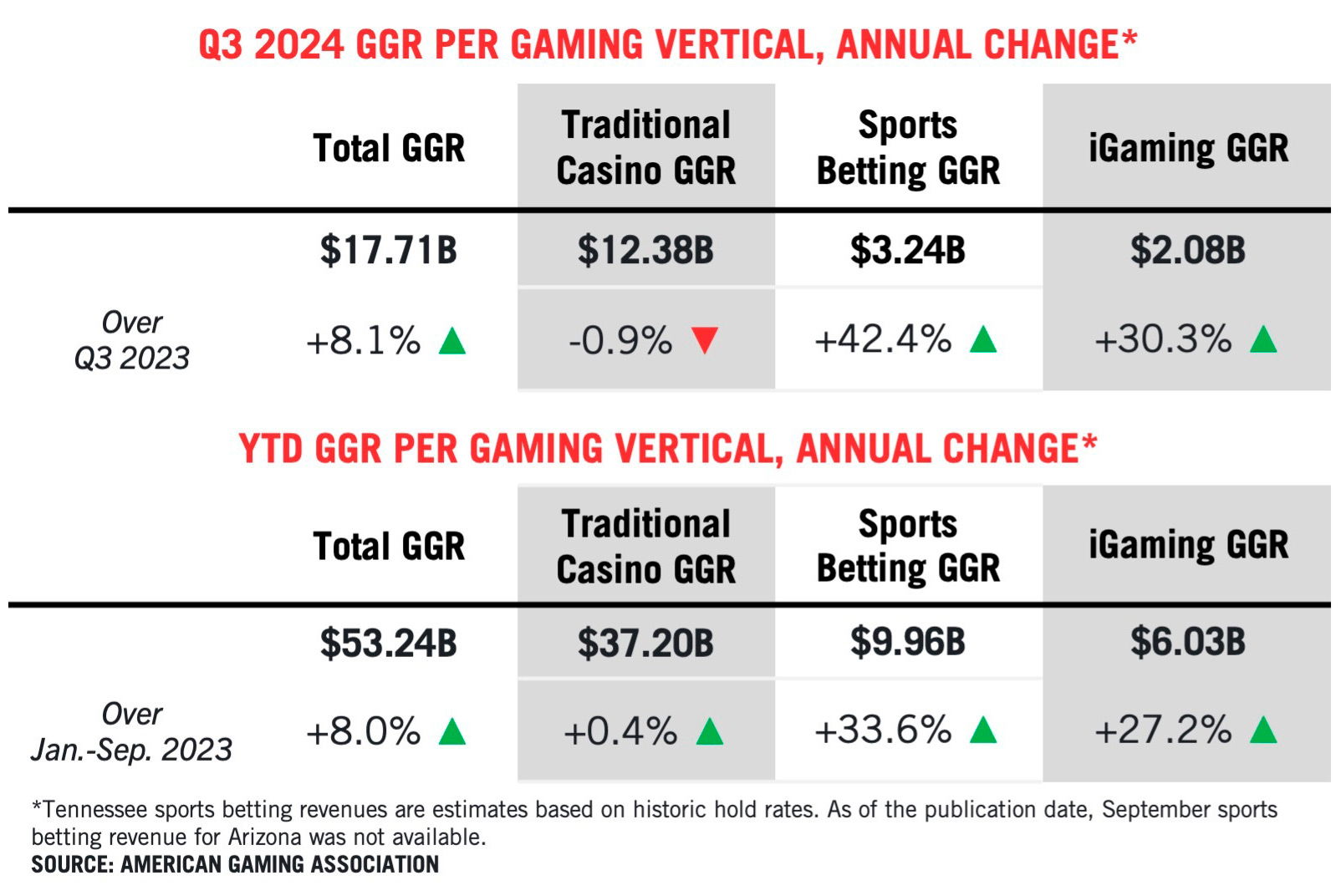

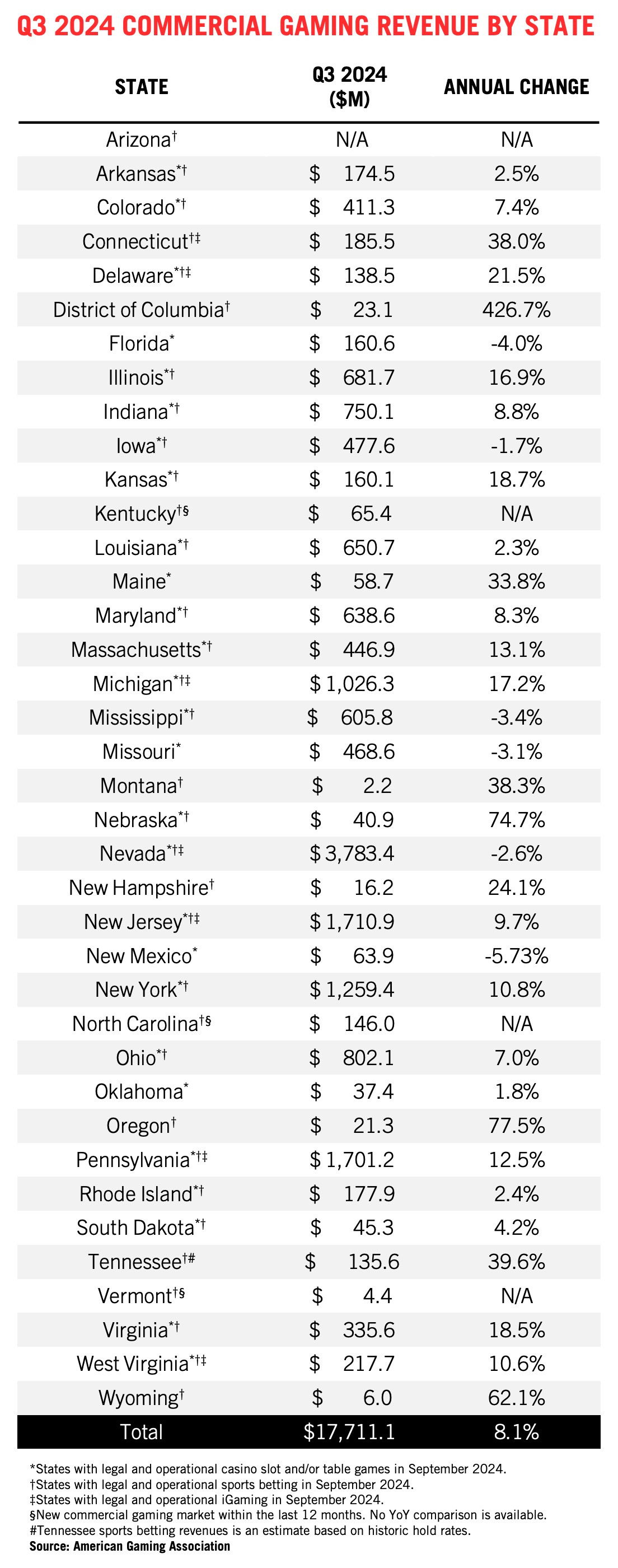

The commercial US gaming industry’s revenue increased by 8.1% reaching $17.71 billion in Q3, according to the American Gaming Association’s Commercial Gaming Revenue Tracker. Q3 was the 15th consecutive quarter of year-over-year growth and it is the highest-grossing Q3 revenue performance on record.

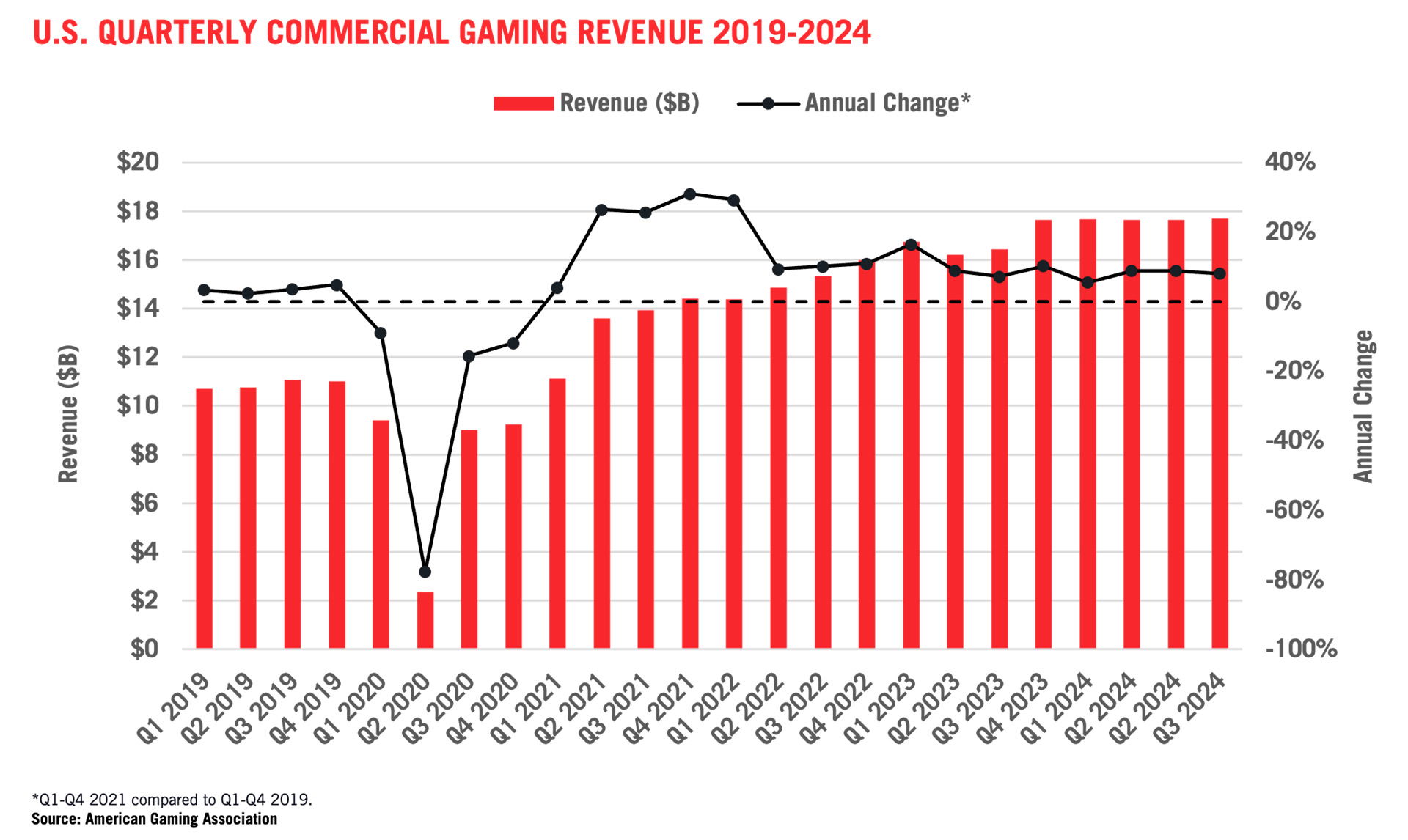

Quarterly revenue from land-based gaming – including casino slots, table games, and retail sports betting – totaled $12.56 billion, 0.62% lower than the same period last year. Meanwhile, online gaming revenue growth accelerated in Q3, increasing 37.9% year-over-year compared to 33.9% in Q2, driven largely by online sports betting.

Combined revenue from online sports betting and iGaming was $5.14 billion in Q3 as online gaming made up 29% of commercial gaming revenue, a significantly higher share than the same period last year.

At the state level, 29 of 35 commercial gaming jurisdictions that were operational a year ago and have complete data available saw gaming revenue growth from 2023.

New Mexico (-5.7%) saw the largest contraction in Q3, followed by Florida (-4.0%). The Florida market was impacted by Hurricane Helene in September and also by increased market competition following the introduction of table games at tribal properties late last year. Other markets with modest revenue declines in Q3 include Missouri (-3.1%), Mississippi (-3.4%), Nevada (-2.6%) and Iowa (-1.7%). Strong sports betting gains moderated traditional betting declines in all of these states but Mississippi.

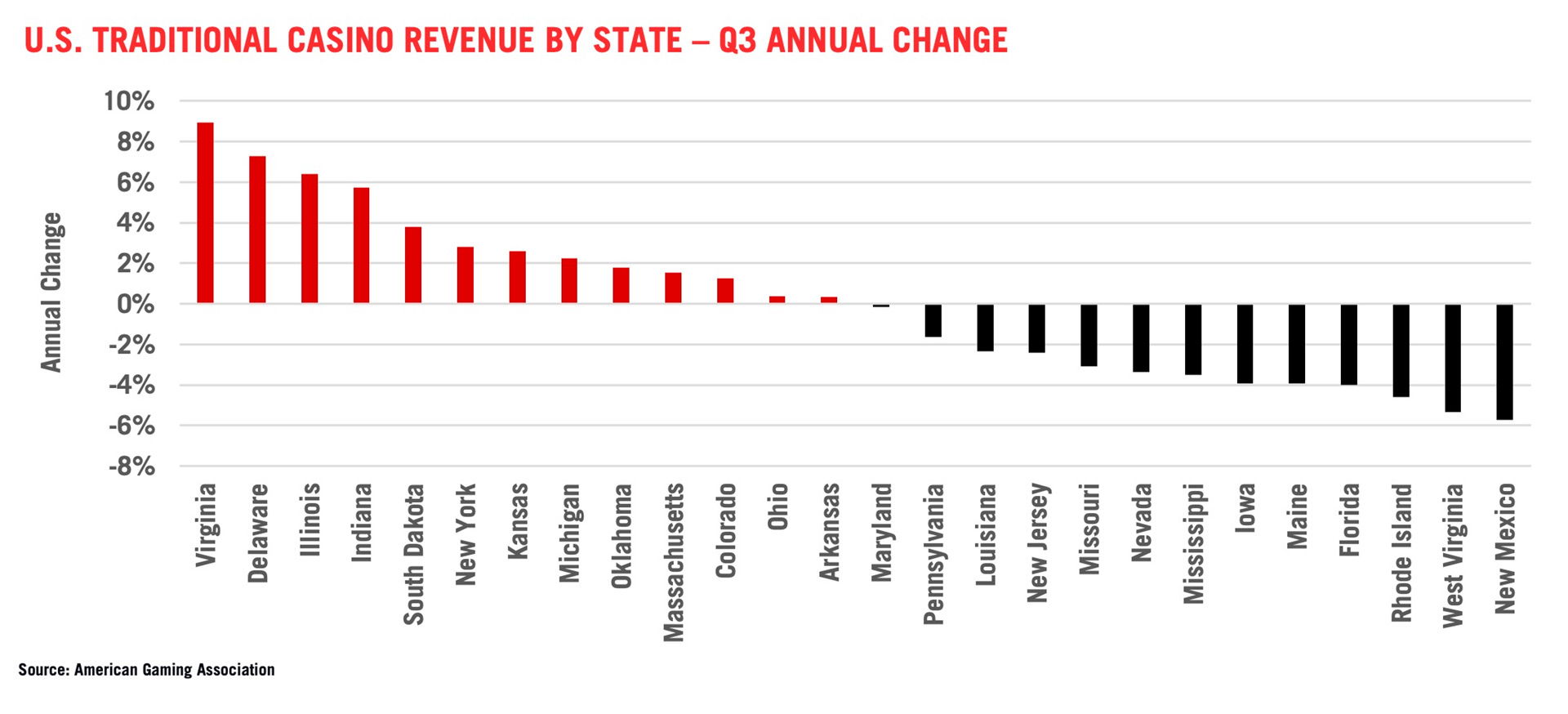

Traditional brick-and-mortar casino gaming revenue contracted annually by less than 1% in the third quarter, with slot machines and table games generating $12.38 billion in revenue. Brick-and-mortar revenue decreased year-over-year in two of the three months in Q3, only rising in August.

Individually, Q3 slot revenue expanded from 2023 while table game revenue contracted. Nationwide, casino slot machines generated $9.10 billion in Q3, up 1.3% from the previous year, while table games produced $2.42 billion, an 8.3% year-over-year decrease.

At the state market level, Q3 results were thoroughly mixed with 13 of 27 markets posting traditional casino revenue declines compared to the prior year by an average of 3.4 percent. The 14 states that expanded traditional casino revenue in the third quarter – by an average of 8.5% – were led by Nebraska, Virginia, Delaware, and Illinois, which all benefited from new property openings.

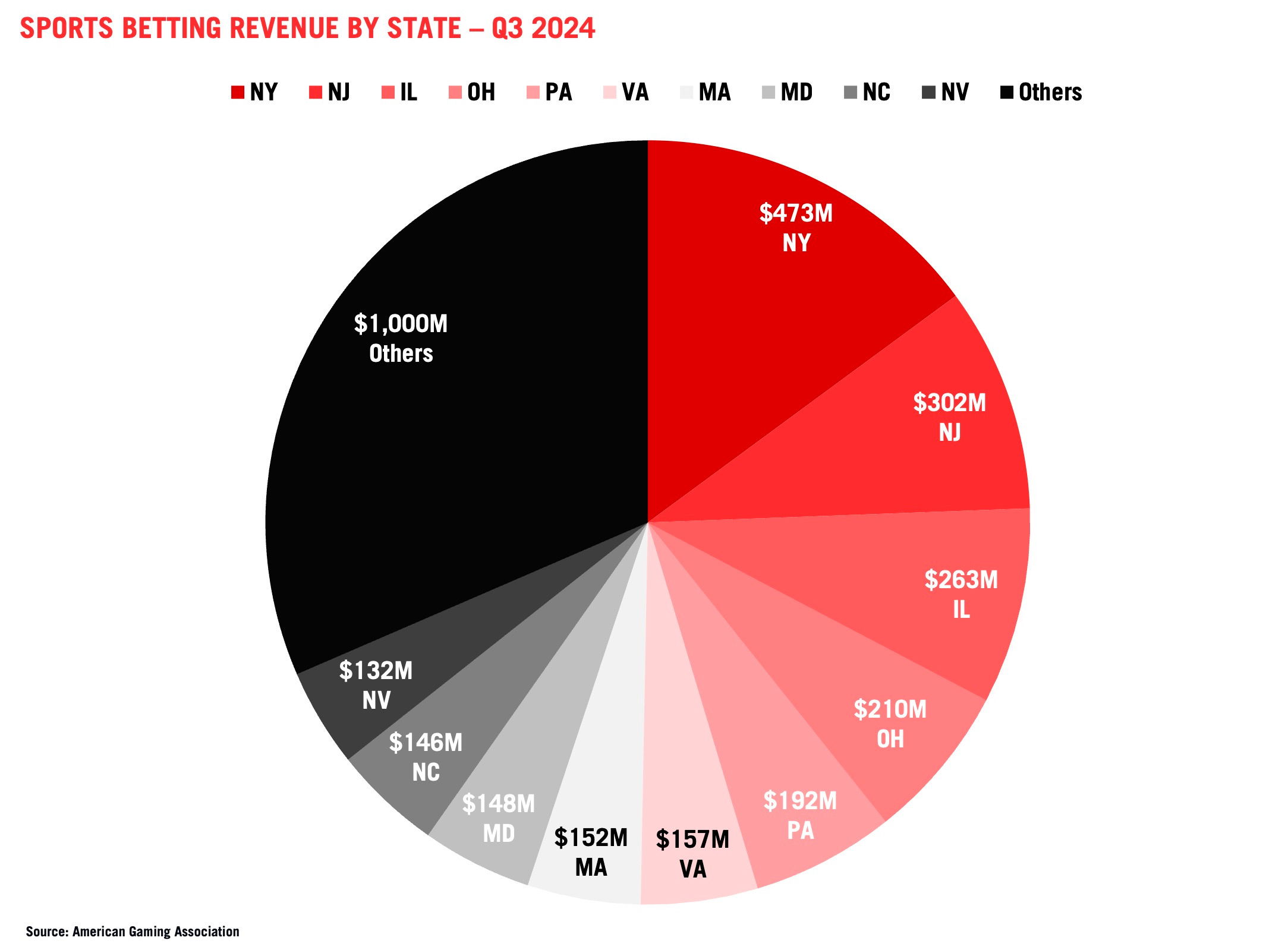

Third-quarter sports wagering revenue grew 42.4% to $3.24 billion, a new third-quarter record for the vertical.

New market launches in Kentucky, Maine, North Carolina, and Vermont since last spring contributed to a robust commercial sports betting handle of $30.33 billion in the third quarter, a 28.8% increase compared to the previous year. Third quarter sports betting hold increased to 11.9% from 10.2% last year, with wide variation between markets.

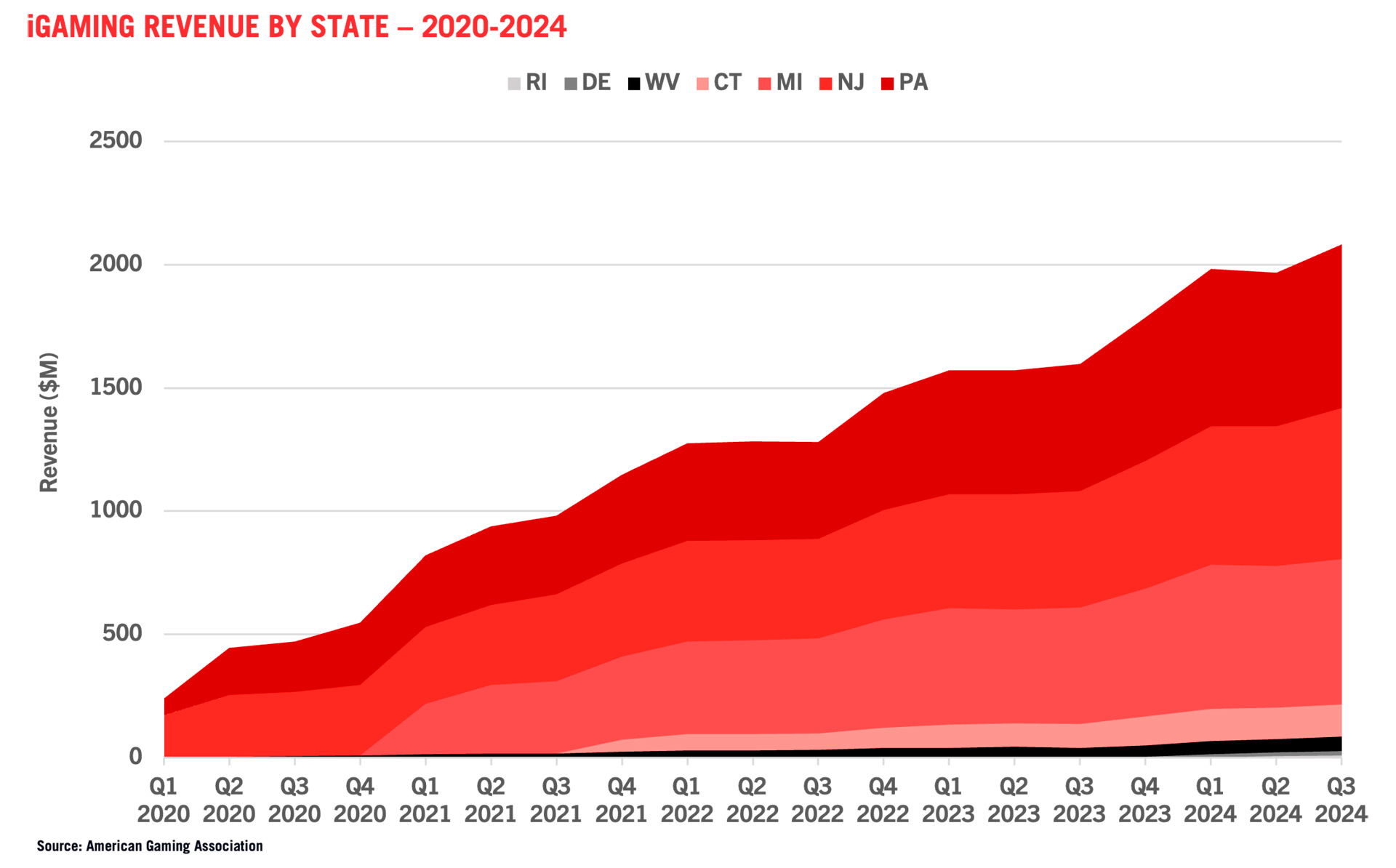

iGaming growth remained strong in the third quarter, generating $2.08 billion of revenue across seven states, up 30.3% over the third quarter of last year. Sequentially, iGaming revenue also increased 6% from the second quarter of this year.

Each of the six iGaming states with 2023 comparisons grew year-over-year in the third quarter, led by 393% growth in Delaware powered by the Delaware Lottery’s new iGaming partner Rush Street Interactive. Each of the other five pre-existing iGaming markets posted annualized quarterly growth of 25-68 percent.

Year-to-date through September, nationwide iGaming revenue stands at $6.03 billion, a 27.2% increase over the same period last year.

Original article: https://www.yogonet.com/international/noticias/2024/11/22/86165-us-commercial-gaming-hits-record-q3-revenue-of-177b-extending-growth-streak-to-15-quarters