For the most part, there is minimal product differentiation between wagering operators, with minor differences in user experience.

In our January 2022 newsletter, we discussed how wagering sites have maintained a consistent layout for decades, typically featuring promotions at the top, then providing high level navigation to the most popular sports, and then giving prominence to the ‘next to jump’ for the major racing codes.

Consequently, with minimal product differentiation, marketing has always played a crucial role in attracting customers to operators.

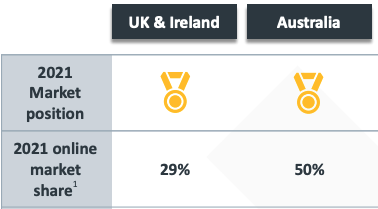

Taking the Australian market as an example, there are around 100 bookmakers competing to win online market share. In Australia, Sportsbet has already gained around 50% online market share. Last year, it generated US$820 million in revenue and spent US$143.5 million on marketing (17.5% of revenue).

In the US, marketing is particularly high compared to mature markets like Australia and the UK because in new wagering markets, operators compete to ‘land grab’ market share. For example, in 2021, FanDuel (Flutter’s US business) spent US$775 million (48% of its revenue) on marketing, while DraftKings spent US$929 million (72% of its revenue).

| Company | 2021 Revenue | 2021 Marketing Cost | Marketing as % of Revenue |

| DraftKings | $1.30bn | $929m | 71.7% |

| FanDuel | $1.63bn | $775m | 47.7% |

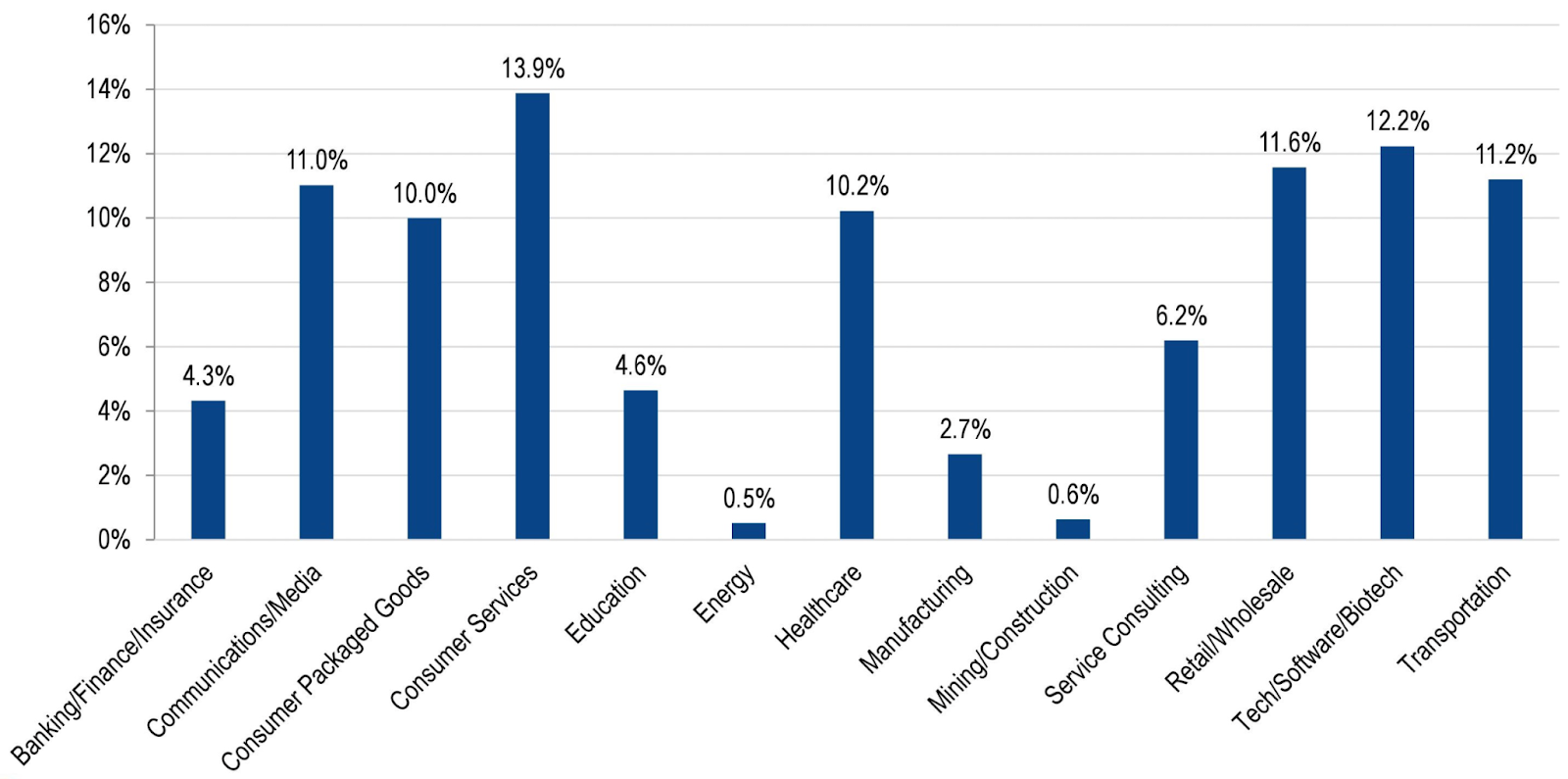

In comparison, companies operating in most industries spend around 11% of revenue on marketing, which is significantly lower than the wagering industry in both mature and new markets.

Over the last 10 years, celebrities have been increasingly used in marketing campaigns. For example, last year, Ladbrokes released a television commercial with actor Mark Wahlberg. This year, the company reimagined the iconic Rocky II running scene.

Influx of influencer marketing

In recent years, we have seen a huge shift in the consumer paradigm towards creator-guided commerce.

The Covid-19 pandemic served to accelerate this trend – when physical retail stores shut down, consumers were restricted to their homes and the only way for a brand to reach an audience was through digital connection. Creators played a huge part in this narrative, ultimately providing brands with a new distribution point for sales.

Creators bring net new customers to a business and provide a performance-based marketing channel that attracts highly engaged shoppers.

Wagering companies are slowly adopting a new approach when it comes to their marketing strategy, with more and more businesses turning to influencers to spread the word.

That’s not to say the value of traditional marketing has been lost; both have a role to play and both serve very different yet important functions.

Traditional marketing is critical at a macro level to build brand awareness, reach mass audiences, and further brand alignment. On the other hand, Influencer marketing allows brands to connect more closely with their customers, creating a more subtle and meaningful way for businesses to drive sales.

While wagering operators have had sportspeople and celebrities as brand ambassadors for many years, they have been relatively slow to add influencer marketing to their tool kit.

One brand ambassador is basketball legend Shaquille O’Neal, who has a partnership with WynnBET in the US and Pointsbet in Australia. In a combination of celebrity and influencer marketing, Shaq recently danced with ‘The Inspired Unemployed’, an influencer with 1.5 million Instagram followers. By partnering with The Inspired Unemployed, Pointsbet is able to target a niche audience of mostly young Australian men.

Influencers are seen as more credible and authentic than traditional marketing. They have highly personalised audiences and have a unique ability to describe product experiences and journeys in a way that is raw and human.

Today’s audiences want to connect with like-minded people rather than celebrities. Consumers are more likely to make a purchase from someone who they feel they know, whose tastes and interests align with theirs.

Influencer marketing has propelled US-based Betr to 116,000 Instagram followers in just 5 weeks. The company leverages the huge audience of its influencer co-founder, Jake Paul, who has 20.6 million Instagram followers and 16.7 million Tik Tok followers.

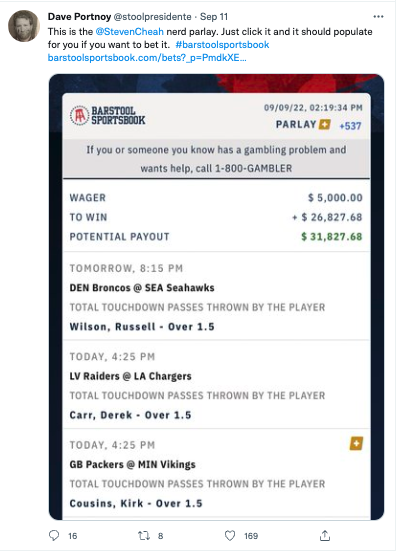

As discussed in our October 2021 newsletter, Barstool Sportsbook leverages the fame of Barstool’s Founder, Dave Portnoy. Barstool has built its brand on the back of authentic personalities and unique content. Portnoy regularly gives his betting tips and posts his betslip, often with a link allowing the viewer to copy his bet automatically through their Barstool Sportsbook account.

In a demonstration of how quickly operators must adapt to regulatory changes, this year, the UK banned the inclusion of sportspeople, celebrities and influencers in wagering ads because of their appeal to youth. Despite this British regulatory change, we believe that influencer marketing could contribute significantly to operators’ customer acquisition on a global level by allowing them to target large niche audiences.

All the best,

Since inception in August 2019, Waterhouse VC has achieved a total return of 1,906% as at 31 August 2022, assuming the reinvestment of all distributions.

DISCLAIMER AND IMPORTANT NOTES

Please note the above information in relation to Wynn Resorts, Entain, Betr, Pointsbet Holdings, Flutter Entertainment, PENN Entertainment and DraftKings is based on publicly available information in relation to the company and should not be considered nor construed as financial product advice. Waterhouse VC has a position in Flutter Entertainment. The information provided in this document is general information only and does not constitute investment or other advice. Readers should consult and rely on professional investment advice specific to their individual circumstances.

General Information Only

This material is for general information only and is not an offer for the purchase or sale of any financial product or service. The material has been prepared for investors who qualify as wholesale clients under sections 761G of the Corporations Act or to any other person who is not required to be given a regulated disclosure document under the Corporations Act. The material is not intended to provide you with financial or tax advice and does not take into account your objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by Sandford Capital, Waterhouse VC or any other person. To the maximum extent possible, Sandford Capital, Waterhouse VC or any other person do not accept any liability for any statement in this material.

Financial Regulatory Oversight and Administration

Waterhouse VC is an Australian Unit Trust denominated in AUD and available to wholesale institutional investors worldwide with a minimum of AUD 1,000,000 or USD / EUR / GBP / JPY / CHF equivalent. This material has been prepared by Waterhouse VC Pty Ltd (ABN 48 635 494 861) (‘Waterhouse VC’, ‘Trustee’, ‘us’ or ‘we’) as the Trustee of the Waterhouse VC Fund (the ‘Fund’). The Trustee is a corporate authorised representative (CAR 1296688) of Sandford Capital Pty Limited (ABN 82 600 590 887) (AFSL 461981) (Sandford Capital) and appoints Sandford Capital as its AFS licensed intermediary under s911A(2)(b) of the Corporations Act 2001 (Cth) to arrange for the offer to issue, vary or dispose of units in the Fund.

Performance

Past performance of Waterhouse VC is not a reliable indicator of future performance. Waterhouse VC Pty Ltd does not guarantee the performance of any strategy or the return of an investor’s capital or any specific rate of return. No allowance has been made for taxation, where applicable. We encourage you to think of investing as a long-term pursuit.

Copyright

Copyright © Waterhouse VC Pty Ltd ACN 635 494 861. No part of this message, or its content, may be reproduced in any form without the prior consent of Waterhouse VC.

Governing Law

These Terms and Conditions of use are governed by and are to be construed in accordance with the laws of New South Wales. By accepting these Terms and Conditions of use, you agree to the non-exclusive jurisdiction of the courts of New South Wales, Australia in respect of any proceedings concerning these Terms and Conditions of use.

Original article: https://igamingbusiness.com/finance/influencer-marketing-differentiating-where-product-cannot/