In its latest analytical article, sports betting and iGaming platform supplier Uplatform shares insights into the future of sports betting and the significant changes this trending market is undergoing as new technologies emerge.

There is a bright future for sports betting in most of the world’s legalized markets. Even though COVID-19 caused a global slowdown, the iGaming industry has made a lot of progress in the past year, both in terms of market growth and new laws that make it easier for previously unregulated industries to progress. As a result, millions of people join the betting community every year, and revenue grows proportionally.

As technology advances, the sports betting market is also undergoing significant changes. This implies that the rate at which new technologies emerge in the industry will increase.

Bets are placed differently now that companies can use artificial intelligence, machine learning, and data analytics. To discover more about the promising future of the iGaming industry, please read the following article.

The Inevitable Growth of Esports Betting

Players are stepping into the future due to Esports. The Esports market has expanded phenomenally since the middle of the 2010s. The number of regular video game players worldwide has grown as technology has made games easier to play and more fun. As the popularity of Esports continues to rise, there has been a growing interest in making bets on these events. In response to this demand, the need for specialized Esports betting software to create websites for betting has become essential.

Fortunately, Uplatform is here to meet this need, providing access to over 300 betting markets, 60+ Esports games, and 9500 pre-match and live events. It’s clear that the Esports audience will only continue to expand, with projections showing that by 2024, about 577 million people worldwide will be watching these events. With Uplatform’s comprehensive offers, betting enthusiasts can stay up-to-date on the latest games and events and enjoy the thrill of placing bets on their favorite Esports teams and players.

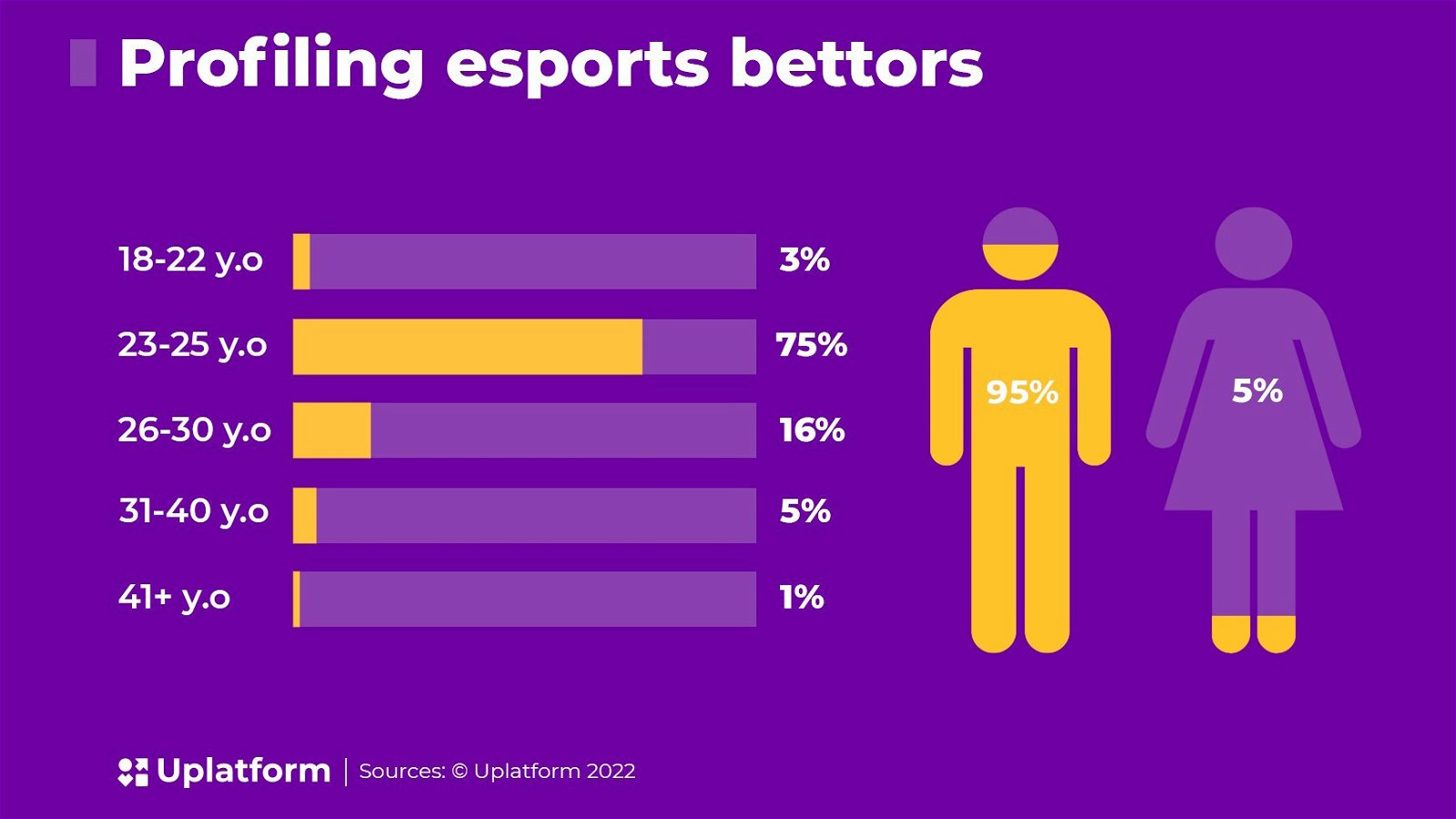

As “bet on yourself” platforms become more popular and Esports gaming becomes more accessible, the types of people who bet on Esports are slowly changing. Today, people from all walks of life and all levels of skill gamble openly and think of it as a norm. The core demographic is shifting, and so is the worldwide future of an Esports betting provider. At the moment, it is believed that between 75% and 80% of Esports bets are made by those aged 23 to 25. Estimates show that between 95% and 98% of the people who bet on Esports are men. The numbers are expected to shift drastically, with women making about 15% of the total Esports betting population by 2024, according to projections.

Changes are also occurring on a global scale. In 2021, the betting industry, including Esports betting, experienced a substantial growth of 20% in Latin America and the Caribbean (LATAM), surpassing Asia and Europe to become the global leaders in this industry. In 2022, the state of New Jersey gave the Esports Entertainment Group a groundbreaking betting license. This started an Esports betting revolution that, in theory, will eventually lead to less strict rules across North America.

Multiplayer video game franchises are the lifeblood of Esports betting. There’s a long list of games that fit the bill as “Esports titles,” but “The Big Three”— “Counter-Strike: Global Offensive,” “Dota 2,” and “League of Legends”—hold sway. Uplatform reported a rough breakdown of market share as follows:

44% of wagers are on Counter-Strike: Global Offensive.

31% of wagers are on Dota 2.

16% of wagers on League of Legends

Bets on everything else make up the remaining 9%.

While there is little chance of a shakeup in this industry any time soon, new entrants appear frequently. In the last few years, games like Call of Duty, Overwatch, Valorant, and Fortnite have been included in our Esports offering, as well as PlayerUnknown’s Battlegrounds, which has been popular for betting on Esports. But even within these games, changes are occurring, and some developments have been ongoing for years.

Next-Generation Gameplay: The Path to Gamification

In 2010, digital games made $25 billion, and their success is often cited as a reason why gamification is used in many online activities. In recent years, the word “gamification” has come to mean interactive online design that appeals to people’s competitive natures by using rewards to engage users. Rewards can be monetary or nonmonetary, such as points, payments, badges, discounts, and “free” gifts, as well as status indicators like friend counts, retweets, leader boards, tournaments, achievement data, progress bars, the ability to “level up.” All of these features can be added via platform solutions.

The platform is a turnkey solution that provides all the necessary tools and services, eliminating the need for separate contacts with providers and payment systems. Uplatform, the sportsbook platform provider, offers all-in-one, ready-to-go, feature-rich, multilingual, multi-device software tailored to operators’ needs and markets’ requirements.

We provide a comprehensive bonus system designed to increase player conversions and retention, boost loyalty and cut costs and risks. Our system includes various promotional types, such as bonuses and tournaments, with highly flexible settings for precise targeting. All our offers are supported by leading providers and have been carefully analyzed for their popularity and potential risks. With Uplatform, you’ll have access to a flexible, multi-currency, and multi-device tool that can expand your business and increase profits.

Impacts of Inflation: The Current Gaming Landscape

Inflation occurs when the supply of goods and services in a sportsbook offering grows slower than the players’ in-game currency. This can happen for several reasons, such as changes to the way the game works, a rise in player interest, or a change in how easy it is to get to in-game resources.

According to iGaming industry consultant Ron Mendelson, the gambling sector has boomed despite the global economic slowdown and the ongoing inflation crisis caused by the COVID-19 pandemic and the Russian invasion of Ukraine. The global sector was valued at around $61 billion in 2021, set to almost double to $114 billion by 2028, driven by a combination of factors, including the pandemic, increased internet accessibility, smartphone usage, and a demand for online entertainment. Here are some key takeaways from Mendelson’s analysis:

Despite global inflation reaching more than 6.7% by the end of 2023, the iGaming sector shows resilience and continued growth.

The US-based industry brought in more than $5.3 billion in revenue in March 2022, the highest figure in the history of American gambling.

Land-based casinos are moving into iGaming with much enthusiasm.

The UK saw a slight decline in online slot revenue and time spent playing, but industry stakeholders are not alarmed.

Portugal saw a nearly 25% year-on-year increase in online gambling revenue in Q4 2022.

Lithuania reported a 90% increase in gambling revenue during Q1 2022, with most of the revenue coming from online slot games.

There has never been a better time to start an online gambling business.

The online gambling sector is growing in popularity, which bodes well for the gambling industry’s future. As more countries legalize online gambling, there are expectations of further expansion in the market, with an influx of new players and companies entering the industry. In addition, technological advancements like virtual reality can potentially revolutionize the online gambling experience by providing a more interactive and immersive gaming environment.

The use of cryptocurrencies such as Bitcoin and Ethereum is also gaining traction, offering players a fast, secure, and anonymous way to make deposits and withdrawals. Artificial intelligence and machine learning are also expected to improve the customer journey and provide personalized gaming experiences.

The growing use of mobile devices for accessing online gambling websites makes it essential for companies to develop user-friendly mobile apps to stay competitive. Additionally, social media platforms are increasingly integrated with online gambling, providing more avenues for players to interact and compete with each other. Overall, the future of the gambling industry is bright, with ample opportunity for continued growth and innovation as companies adapt to changing trends and embrace new technologies.

The Bottom Line

Esports is growing steadily, and the fact that gaming elements are being added to the sports betting market is another sign that the industry has a bright future. iGaming has given fans a new way to get involved with the game, and guessing the results of hundreds of games in a single tournament has grown into a strong community. Each bettor may now test their knowledge and see how they rate compared to other players and industry professionals. Sports media is experiencing a transition, but it’s vital to remember that fans are still out there; we simply have to find new ways to connect with them.

With Uplatform, you can trust that you are well-equipped for the future demands of online sports betting. You can put your worries to rest because we are committed to helping your betting business grow by providing high-quality and hassle-free sportsbook solutions tailored specifically to your needs. Uplatform is the most user-friendly, extensive, and flexible platform available today. You might be able to start a successful business with the help of our large sportsbook, the industry’s largest collection of casino games, and our exclusive services. Benefit from our expertise in sports betting and the industry’s top-tier software.

Original article: https://www.yogonet.com/international/news/2023/04/25/66937-the-future-of-sports-betting-esports-gamification-inflation