Yield Sec uses predictive analytics in its report. The report is for sports betting and online gambling only and reveals $10.8bn in GGR on legal platforms. According to the report, there were 892 illegal operators working in the US in the first half of 2024. In addition, 651 affiliates were promoting illegal platforms.

In 2023, Yield Sec predicted that the US market was $40.9bn in GGR for the year. It appears the 2024 numbers will easily eclipse that. Two new US states entered the live US market in 2024 — North Carolina and Vermont. No US jurisdictions legalised wagering in 2024. North Carolina is the ninth-biggest US state by population and the sixth-biggest legal betting state by population.

Through its first five months of live wagering, North Carolina operators took $340m in wagers and reported revenue of $42m.

Legal, illegal markets continue to grow

Earlier this year, Yield Sec released a report that estimated that two-thirds of Super Bowl bets made in the US were on illegal platforms.

“Legal operators are under serious pressure,” Yield Sec CEO Ismail Vail said. “The focus needs to be on the $29.1bn lost to illegal gambling in the first half of 2024 alone. It’s not rocket science. We’ve identified precisely where this loss of revenue is being realised, we just need to redirect it back into the pockets of legal operators so that additional revenue can be taxed and the industry can fulfill promises of fair, safe and responsible online gambling.”

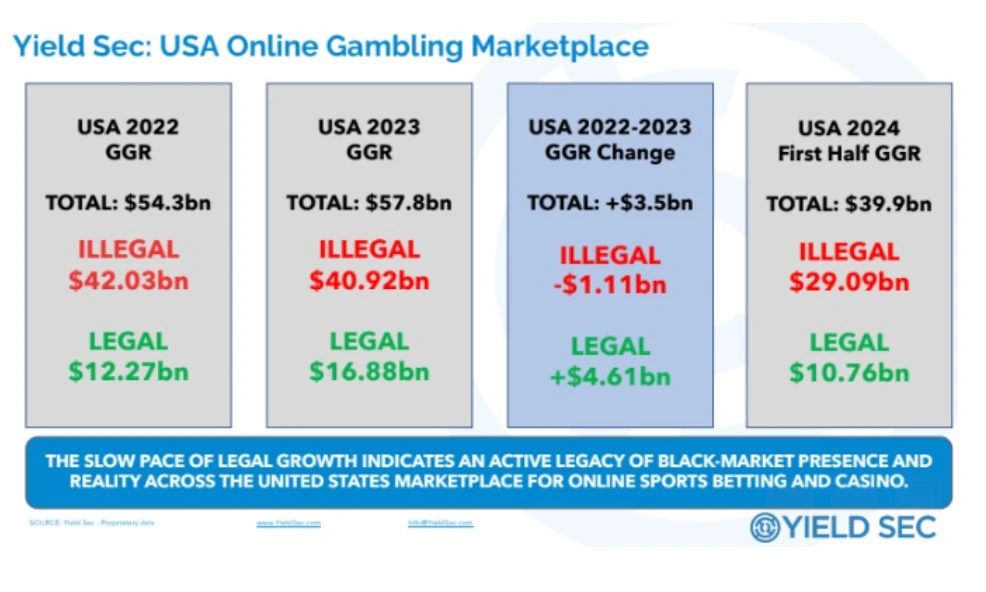

Yield Sec shared similar reports dating back to 2022. While they show growth in the legal market, the reports also show strong growth in the illegal market. For comparison, the company reported that the illegal market accounted for $42bn in GGR in 2022, $40.9bn in 2023, and $29.1bn in the first six months of 2024. By that measure, the illegal market could grow to $60bn in GGR by the end of 2024.

While there was a dip in predicted illegal US GGR in 2023, it appears there will be significant growth in 2024.

The legal market, according to Yield Sec, accounted for $12.3bn in GGR in 2022, $16.9bn in 2023 and $10.8bn in the first half of 2024. Following those projections, the legal market could account for $20bn or more by the end of the year.

Those figures are in line with data from the American Gaming Association’s (AGA) commercial revenue tracker. The AGA’s legal sports betting and iGaming GGR total for H1 2024 was $10.62bn. Its totals for 2023 and 2022 were $17.21bn and $12.52bn, respectively.

Wagering GGR could double this year

It’s likely that the numbers for both the black and legal markets will be more than double current numbers by the end of the year. The college football season kicked off 24 August and the NFL season is set to kick off 5 September. The four-month span at the end of the year traditionally accounts for about 35% of US operator handle.

Yield Sec, a market intelligence platform, uses AI to trawl the web for gambling-related keywords, and then refines the gathered information. Using legal-market figures as a benchmark, the company applies machine learning to make illegal-market predictions.

Yield Sec’s black-market numbers are predictions, but the company says it can predict legal-market scenarios with accuracy as proof its system is valid. According to a spokesperson, Yield Sec predicted GGR for the 2024 Super Bowl within about 3% accuracy.

Original article: https://igamingbusiness.com/gaming/yield-sec-sports-betting-illegal-market/