Blackstone has provided nearly AU$500 million ($337 million) in financial support to Crown Resorts in 2023, according to the Australian Financial Review. The capital injection comes as the casino operator grapples with ongoing regulatory challenges and a decline in high-roller customers.

The funding came shortly after Crown faced an AU$450 million ($300 million) penalty imposed by AUSTRAC for breaches of anti-money laundering and counter-terrorism financing laws. The capital injection aims to maintain operations and support remediation efforts at a time when costs are rising and VIP spending has diminished.

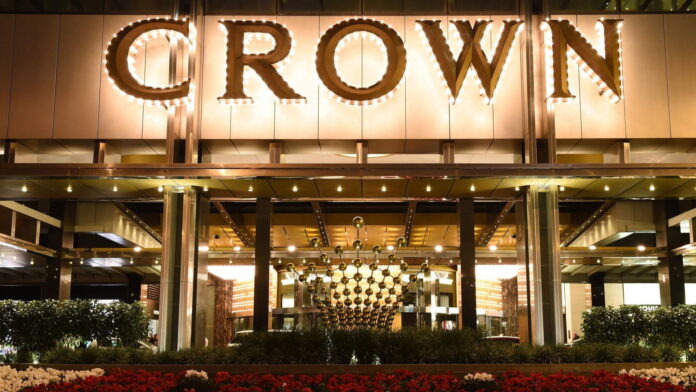

Crown Resorts, Australia’s largest casino operator, was acquired by Blackstone in 2022 for AU$8.9 billion ($6 billion). Since then, the company has spent over AU$200 million on various initiatives to enhance operations and compliance, according to CEO Ciarán Carruthers, who took the helm after the acquisition. However, Carruthers is set to depart from his role, and no permanent replacement has been named yet.

In light of the financial pressures, Crown is also exploring the sale of non-essential assets, including its Capital Golf Club and a 20% stake in the Nobu restaurant chain, in an effort to stabilize its finances amid increased scrutiny and changing consumer behavior.

“I knew the funding was going to be made available from Blackstone and we spent over AU$200 million since that acquisition in making sure that the work was there and the resources were there,” Carruthers told AGB back in May.

Sources indicate that Blackstone’s funding is critical for Crown as it navigates the complexities of the regulatory landscape while attempting to revive its core business amid a challenging environment for VIP customers.

Original article: https://www.yogonet.com/international/noticias/2024/10/17/82242-blackstone-injects-nearly-337-million-into-struggling-crown-resorts