The state’s senate budget and taxation committee held an informational hearing that ran three hours. There was an almost even split between proponents and opponents testifying on SB 340, which would legalise Maryland igaming. There was no vote.

Both sides made impassioned arguments, but the issue that rose to the top was cannibalisation. The shift of gambling revenue from land-based casinos to digital platforms has become a key issue across the nation when debating whether or not to legalise online casino.

Cannibalisation has divided the gambling industry. Smaller, regional casinos say digital platforms take customers and, ultimately, revenue from land-based casinos. This results in job losses and stress on the retail casino business.

There is no question that online casino raises gambling revenue on the top line. In the seven online gambling states in the US, revenue from that dwarfs revenue from land-based venues. The question is who benefits and who suffers.

Cordish: Igaming “bad for Maryland”

The Cordish Companies, which owns the Live! Casino in Maryland, was the first to raise the issue. The company’s testimony during Maryland igaming hearings in 2024 put the brakes on legalisation. Representatives from the company have testified in other states, including Louisiana, where in December they said they oppose legalisation. But the company would participate in the market if available. Cordish already offers icasino in Pennsylvania.

Cordish representative Mark Stewart said on Wednesday that Pennsylvania lawmakers legalised igaming before Cordish was licensed. “So we got a licence,” he said. “We could make a tremendous amount of money on legal igaming in Maryland. But we are telling you not to do it because it is bad for Maryland, it is bad for us and it is bad for our team members.”

Stewart said that his company hired one person to operate online casino in Pennsylvania versus 3,000 for its retail operation. He said Cordish invested $500,000 on igaming and $900 million on its brick-and-mortar facilities.

Penn Entertainment’s Caitlyn McDonough echoed Stewart’s comments, saying her company opposes the bill but not igaming. She said she believes there is a better way to create a framework that is “complimentary” to Penn’s Hollywood Casino Perryville.

Pennsylvania comparison

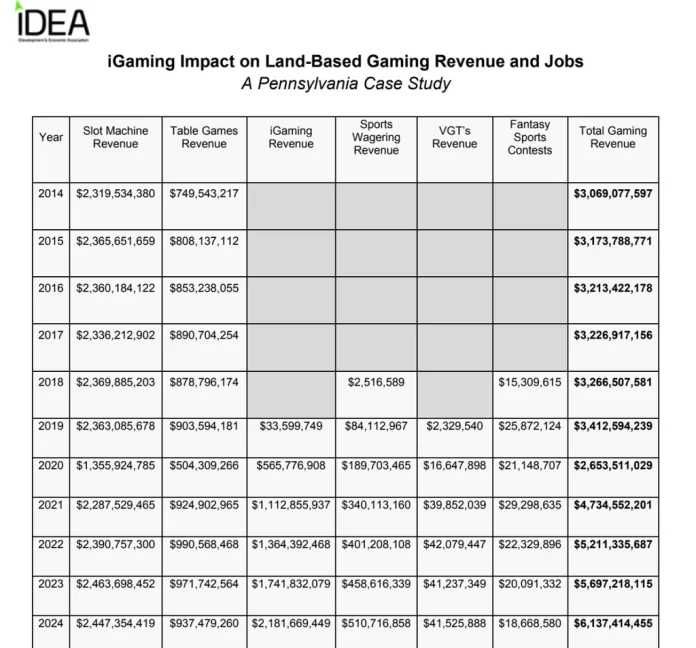

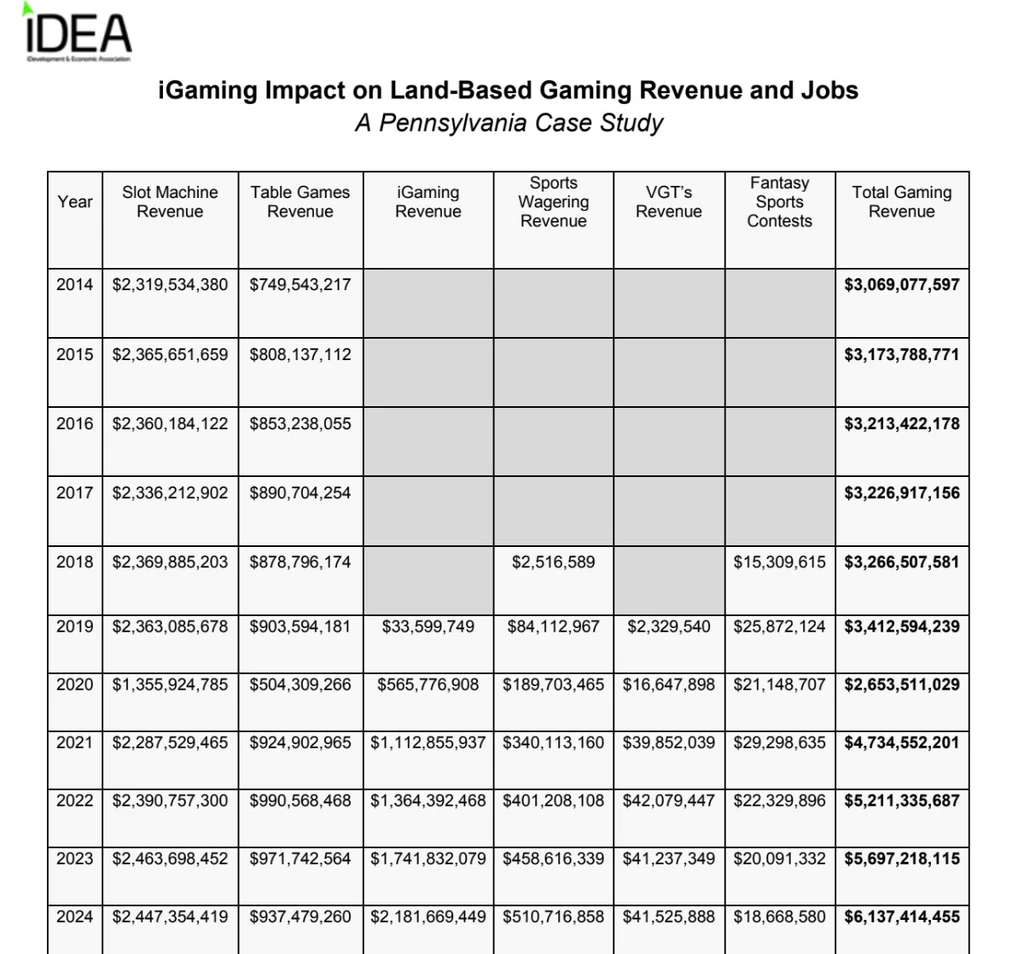

John Pappas, on behalf of the iDevelopment and Economic Association (iDEA), said that according to the latest Pennsylvania revenue report, the Cordish Companies’ retail and digital casinos had increased revenue. He said the report showed an 11% increase in retail slots and an 18% increase in online gambling revenue.

“This shows it can be done, both can rise,” he said. “In every state with legal igaming, the amount of tax revenue in the state has risen.”

Bobby Jones, the general manager at Ocean Downs Casino, said that online casino has a “significant negative impact” on smaller brick-and-mortar casinos. She saw this first hand, she said, when Pennsylvania legalised. The Presque Isle Casino suffered a 15% decrease in revenue and had to release 45% of its employees, Jones said. She fears the same will happen in Maryland.

But Elise Cohen, owner of Longshot’s, the only wholly women-owned sportsbook in the US, testified in support of legal online casino. Arguing for the opportunity for her company to be able to apply for a licence, Cohen said, “I disagree that igaming will ruin brick-and-mortar. Rather, retail and online must be viewed as two equally important aspects of the same business. Both build upon the other as consumers look for dynamic ways to engage in gaming. Sports betting and igaming are complements.”

Jerry Evans, on behalf of the Bingo World and Rod ‘n Reel bingo halls, testified that he is asking for SB 340 to be amended. He wants to include bingo halls as licensees and ban online casinos from offering bingo. Without those changes, he said, bingo halls will “go out of business… it will be the end of commercial bingo in Maryland.”

Is igaming tax revenue bump real?

Stewart of the Cordish Companies was among the last testifiers on Wednesday. He opened by saying the company has opposed igaming legislation in every jurisdiction it operates in.

“There is a growing mountain of evidence against igaming and its many harms,” he said. “Government and university studies, skyrocketing helpline calls in igaming states, underage gambling increases and more.”

He also referenced a Harvard conference about the ills of gambling and noted that 24% of casino jobs disappeared in Pennsylvania after igaming was introduced. He said the job losses will hurt unions and that many of the jobs in question are filled by those “with a high school diploma or less”.

“The claimed tax revenue is a mirage, as you’ve heard. The real question is what is the net tax impact?” he asked. “After accounting for cannibalisation and lost jobs and social costs and lost economic output, which accounts for hundreds of millions of dollars, the reality is there is no material tax revenue benefit for the state.

“Studies show that legalising igaming does nothing to stop the illegal market. In fact it only grows. We wouldn’t legalise fentanyl – enforcement is the answer.”

Illegal market

Another common thread Wednesday was stamping out the illegal market. Proponents of online casino say that creating a legal framework gives states a tool to start to eliminate the black market. At the start of the hearing, West Virginia representative Shawn Fluharty told fellow lawmakers that he sat in the hearing room and logged onto the illegal platform “Cafe Casino” and could play while waiting to testify.

He went on to share that states with a legal framework, in particular Michigan, were using these tools to chase illegal operators from their markets.

Former New Jersey Division of Gaming Enforcement chief Dave Rebuck told the committee that the “illegal gambling market… pays no taxes. Today, every state in the nation faces this problem, but there is proof of concept that providing a multi-pronged approach” can tamp down the black market.

In his introduction, Watson pointed to the illegal market in Maryland, saying that “we recognise that there is an illegal igaming market of $200 million per year, but we have no way to (eliminate) that because we don’t have a bill.”

Watson said the projection for a legal igaming market in Maryland is $300 million in revenue.

Minority businesses: Include us

Maryland’s igaming bill has a unique component also found in its legal sports betting law. State lawmakers laid out a framework to help minority and women-owned businesses enter the sector. Discussion on this issue was heated.

Dallas Barnes, representing Urban One, said his group supports SB 340 because it “would help support our minority population.” Urban One is the “leading voice speaking to Black America,” according to its website. The company is based in Maryland and has tried to enter the legal gambling market in Maryland and Virginia.

Antonio Jones is a partner in the Riverboat on the Potomac, which offers retail and digital sports betting in partnership with Fanatics Sportsbook. He said his company took advantage of minority business opportunities from the state to open its sportsbook. It would do the same for igaming. But he’d like to see the current bill amended to reduce licensing fees for minority owned businesses. And he’d like the “debt account” created by the state for gambling businesses to be increased. “Funds dried up pretty quickly with sports betting,” he said.

SB 340 includes a robust section about minority and women-owned businesses. But it would not allow for many small businesses to apply for licences. Besides Jones, the owners of several local sportsbooks and bingo halls asked lawmakers to expand the licensing pool.

Under the current version of the bill, existing casinos, sports betting facility licence holders and video lottery operators are among the list of potential applicants. Class ‘B’ licence holders – which, for the most part encompass the small businesses – are not eligible in the current version of the bill. Existing small sportsbook and bingo hall owners argued for their right to be licensed. But others said that the $1 million licence fee would prohibit small businesses from participating.

Other reasons not to legalise

Problem and responsible gambling advocates spoke out during the hearing, as well. Some argued against legalisation due to the harm that it can cause. Others asked for proper funding for addiction services should the bill pass.

Kristen Pironis of Visit Annapolis made a compelling argument against legalising Maryland igaming that had nothing to do with revenue, harm or cannibalisation. It had to do with people.

“We work to create a vibrant tourism community… it is not a simulated experience,” she said of her organisation. “Simply stated, fewer people in our casinos means those folks won’t be staying in our hotels, they won’t be eating in our local restaurants and they won’t be patronising our local shops. It’s not just about the gaming revenue we’re talking here today. It’s about that tourism ecosystem and what is built up around those casinos.

“You don’t build up a community around the internet. You don’t build up a community around a phone.”

Original article: https://igamingbusiness.com/gaming/online-casino/maryland-igaming-hearing-2025/